Get Sc Dor Sc1040 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC1040 online

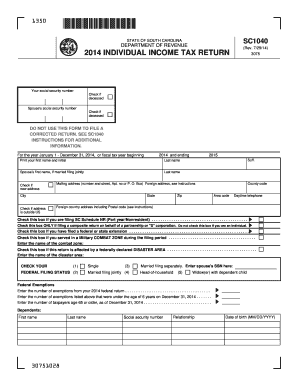

The SC DoR SC1040 is the individual income tax return form for South Carolina. Filling out this form online can simplify the process and provide faster results. This guide provides step-by-step instructions to help you accurately complete the SC1040 form online.

Follow the steps to fill out the SC DoR SC1040 online successfully.

- Press the ‘Get Form’ button to access the SC1040 form and open it for editing.

- Enter your social security number in the appropriate field. If applicable, check the box indicating if you are deceased.

- Provide your spouse's social security number if you are filing jointly and check the box if they are deceased.

- Fill in your first name and initial, followed by your last name. If you are married and filing jointly, include your spouse’s first name and last name.

- Indicate if you have a new address by checking the corresponding box and provide your mailing address, including city, state, and zip code.

- If applicable, check the box indicating that your address is outside the United States.

- Complete your daytime telephone number and any relevant foreign country information if you reside overseas.

- Determine your filing status by checking the appropriate box based on your federal filing status.

- Input the number of exemptions claimed on your federal return and any relevant details about dependents.

- Fill in the income fields with your federal taxable income and note any additions or subtractions to your federal tax calculations.

- Follow the instructions in the form to calculate your total tax due. Include any credits or deductions as necessary.

- Review all entered information for accuracy and completeness.

- Finally, save your changes, and you can download, print, or share the completed form as needed.

Start completing the SC DoR SC1040 online today for a streamlined and efficient filing experience.

Get form

Yes, you can file your South Carolina taxes online, providing a convenient and efficient option for taxpayers. Using e-filing for your SC DoR SC1040 helps accelerate processing and may also result in faster refunds. Various online platforms offer this service, including our own, which is designed to make the process user-friendly. Embrace the ease of online filing to manage your taxes effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.