Get Sc Dor Sc Sch.tc-48a 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC SCH.TC-48A online

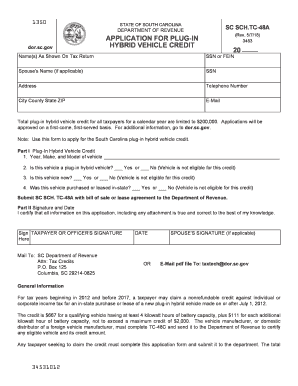

This guide provides a clear and supportive approach to completing the SC DoR SC SCH.TC-48A form, which is required for applying for the South Carolina plug-in hybrid vehicle credit. By following these steps, you will be able to successfully submit your application online.

Follow the steps to complete your application accurately.

- Press the ‘Get Form’ button to access the SC DoR SC SCH.TC-48A form and open it in your preferred online editor.

- Fill out the 'Name(s) as shown on tax return' section. Ensure that the names are spelled correctly as they appear on your tax documents.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the designated field.

- If applicable, provide the spouse's name and their SSN. If you are filing individually, this section can be left blank.

- Complete the 'Address' field by entering your street address, city, county, state, and ZIP code.

- Fill in your telephone number to ensure the Department can contact you if needed.

- Provide your email address for any necessary correspondence regarding your application.

- In Part I, indicate the year, make, and model of your vehicle in the appropriate field.

- Answer 'Yes' or 'No' to confirm whether the vehicle is a plug-in hybrid vehicle. If 'No', the vehicle is not eligible for the credit.

- Indicate if the vehicle is new by selecting 'Yes' or 'No'. A 'No' answer means it does not qualify for the credit.

- State whether the vehicle was purchased or leased in South Carolina by checking 'Yes' or 'No'. If 'No', the vehicle will not qualify for the credit.

- Once all sections are complete, review your application for accuracy.

- Submit your SC DoR SC SCH.TC-48A form along with the required bill of sale or lease agreement to the Department of Revenue, either by mail or as an email attachment.

- Save a copy of the completed form for your records and consider printing it for future reference.

Complete your SC DoR SC SCH.TC-48A application online today and take advantage of the plug-in hybrid vehicle credit!

Determining your qualification for an education tax credit involves reviewing your income, filing status, and the type of expenses you incurred for education. Carefully assess the IRS requirements for various credits, like the American Opportunity credit and Lifetime Learning credit. Keeping detailed records will aid you in evaluating your eligibility and maximizing potential savings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.