Loading

Get Sc Dor Sc 990-t 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC 990-T online

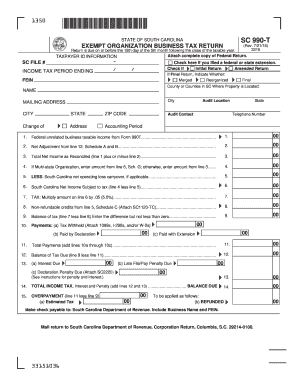

This guide provides a comprehensive overview of how to complete the SC DoR SC 990-T form online. It is designed to assist users, regardless of their prior experience with tax forms, in accurately filling out each section of the return.

Follow the steps to effectively complete the SC DoR SC 990-T form.

- Click the ‘Get Form’ button to obtain the SC DoR SC 990-T form and open it in the editor.

- Provide your taxpayer identification information, including SC file number and FEIN, in the designated fields. Make sure to check the boxes for any applicable status such as 'Initial Return', 'Amended Return', or 'Final Return'.

- Fill in the income tax period ending by entering the relevant date. For new organizations or those moving from other states, ensure you accurately indicate the Fiscal Year End.

- In the income section, start with line 1 by entering your federal unrelated business taxable income from Form 990-T. Refer to your federal return for the correct amount.

- Proceed to line 2 and enter the net adjustment from lines 12 of Schedule A and B. Ensure that you add or subtract accurately based on your calculations.

- Calculate your total net income as reconciled by adding or subtracting the amounts from lines 1 and 2. Enter the result on line 3.

- If your organization operates in multiple states, refer to Schedule G to determine the amount for line 4. Otherwise, transfer the total net income from line 3.

- Deduct any South Carolina net operating loss carryover on line 5, if applicable. This holds importance for fulfilling tax obligations accurately.

- On line 6, enter your South Carolina net income subject to tax, calculated by deducting line 5 from line 4.

- Calculate the tax due by multiplying the amount on line 6 by 0.05 (5%) and enter it on line 7.

- Complete any relevant non-refundable credits on line 8, making sure to attach SC1120-TC.

- Calculate the balance of tax due by subtracting line 11 (total payments) from line 9 on line 12.

- If applicable, enter any interest due on line 13 and calculate your total income tax, interest, and penalty on line 14.

- Make sure to review the form for accuracy, ensuring all fields are filled appropriately.

- Once completed, save your changes, then download, print, or share the form as needed.

Complete the SC DoR SC 990-T form online today to ensure compliance with tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain a South Carolina tax exemption certificate, you will need to submit an application to the South Carolina Department of Revenue. This process often requires showing proof of your eligibility for tax-exempt status under local laws. Once approved, you will receive your certificate, allowing you to take advantage of the exemptions applicable under the SC DoR SC 990-T guidelines.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.