Get Sc Dor Sc 990-t 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC 990-T online

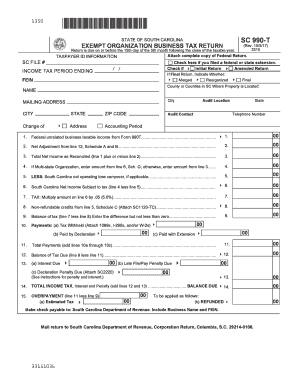

Filling out the SC DoR SC 990-T online can seem daunting, but with this comprehensive guide, you can navigate each section with confidence. This document is vital for reporting your organization's unrelated business income to the South Carolina Department of Revenue.

Follow the steps to successfully complete your SC DoR SC 990-T online.

- Click 'Get Form' button to access the SC DoR SC 990-T and open it in the editor.

- Enter your taxpayer ID information, including your SC file number, federal employer identification number (FEIN), and the income tax period ending date.

- Indicate whether you are filing an initial return, amended return, or final return. If applicable, check the box to indicate if you filed for an extension.

- Fill in the name, mailing address, and contact information for the organization, ensuring all information is accurate and complete.

- In the income section, report the federal unrelated business taxable income as it appears on Form 990-T, as well as any adjustments or deductions affecting your total net income.

- Calculate the South Carolina net income subject to tax by considering any applicable net operating loss carryovers.

- Enter the tax amount, multiply the SC net income subject to tax by 5%. Then list any non-refundable tax credits and calculate the balance of tax due.

- Complete the payments section by detailing any tax withheld or payments made by declaration, then sum these amounts.

- If applicable, fill out the sections related to interest due and late payment penalties, ensuring clarity for any additional charges.

- Finally, review all entries for accuracy, then save your changes. You can download, print, or share the completed form to submit it to the South Carolina Department of Revenue.

Start completing your SC DoR SC 990-T online today!

Get form

Related links form

Form 990 and Form 990-T serve different functions within tax reporting. Form 990 focuses on the organization’s overall financial health, detailing operations, governance, and expenses. Meanwhile, Form 990-T specifically addresses taxes owed on unrelated business income. Understanding these distinctions helps organizations maintain compliance. For guidance on filing both forms, consider platforms like US Legal Forms for easier access to necessary resources.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.