Loading

Get Sc Dor Pt-100 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR PT-100 online

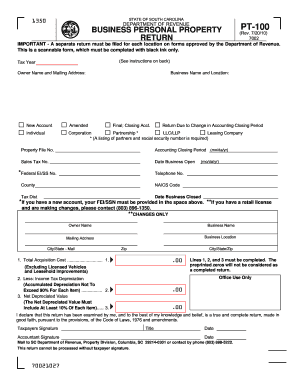

The SC DoR PT-100 is a crucial form for reporting business personal property in South Carolina. This guide will provide step-by-step instructions on how to complete the form online efficiently and accurately, ensuring compliance with state regulations.

Follow the steps to fill out the SC DoR PT-100 online.

- Click the ‘Get Form’ button to access the PT-100 form, which you can then open in your preferred online editor.

- Enter the tax year for which you are filing the return.

- Fill in the owner’s name and mailing address in the designated fields.

- Provide the business name and its physical location.

- Indicate whether this is a new account or if you are amending a previous return by selecting the appropriate option.

- Specify the type of entity (individual, corporation, partnership, LLC/LLP, leasing company) relevant to your business.

- If applicable, note down your property file number and accounting closing period (month/day/year).

- Enter other required information including your sales tax number, date business opened, federal EI/SS number, and telephone number.

- Complete the fields for the county and NAICS code.

- If your business has closed, provide the relevant closure date.

- For reporting total acquisition costs, input the amount in line 1, ensuring that you do not include licensed vehicles or leasehold improvements.

- In line 2, indicate the total depreciation, which should not exceed 90% of the total acquisition cost for each item.

- Calculate and enter the net depreciated value in line 3, ensuring to include at least 10% of each item's value.

- Sign and date the form to validate it, noting that the return cannot be processed without these signatures.

- Once all fields are accurately filled out, save your changes, and you may print, download, or share the completed form as needed.

Complete your SC DoR PT-100 online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out an Employee Withholding exemption Certificate, enter your basic information at the top and indicate any exemptions you qualify for. Be clear on the number of allowances and ensure accuracy in your entries. The SC DoR PT-100 will help streamline this process, guiding you to correctly report your withholding instructions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.