Loading

Get Sc Dor Pt-100 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR PT-100 online

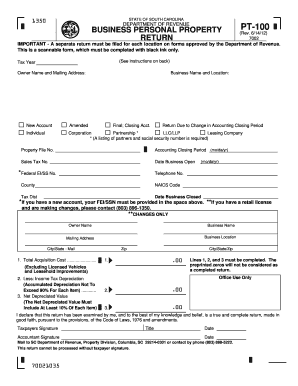

The SC DoR PT-100 is a vital document for reporting business personal property in South Carolina. Completing this form correctly is essential for compliance with state tax regulations. This guide provides a comprehensive, step-by-step approach to filling out the SC DoR PT-100 online, ensuring that users understand every section of the form.

Follow the steps to accurately complete the SC DoR PT-100 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the required tax year at the top of the form to indicate the reporting period for your business personal property.

- Enter the owner's name and mailing address, making sure all details are accurate for correspondence purposes.

- Complete the business name and specific location where the property is held, being clear and precise.

- Select whether this is a new account, amended return, or other options by marking the appropriate box.

- Fill out the property file number, accounting closing period, and federal employer identification number (EI/SS No.) as applicable.

- Indicate the telephone number, county, NAICS code, and any other relevant tax district details required.

- For businesses that are new or have undergone changes, make sure to update the owner name, business name, mailing address, and location in the designated 'Changes Only' section.

- Complete lines 1, 2, and 3 accurately with total acquisition costs, less income tax depreciation, and net depreciated value. Ensure all calculations are performed correctly.

- Sign and date the form to certify that the information provided is true and complete. If applicable, ensure the preparer's signature is also included.

- Review the completed document for accuracy, save your changes, and consider downloading or printing the form for your records.

Ensure compliance and accuracy by completing the SC DoR PT-100 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The amount of business personal property tax in South Carolina varies depending on the type of property and the local tax rates applicable in your area. Generally, the tax rates can range from 4% to 10.5% of the assessed value. For precise figures, utilize the SC DoR PT-100 as a resource to help guide your tax planning.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.