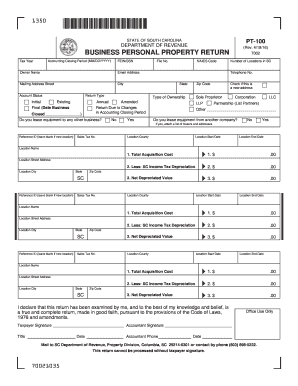

Get Sc Dor Pt-100 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign SC DoR PT-100 online

How to fill out and sign SC DoR PT-100 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing tax documentation can evolve into a major obstacle and a considerable nuisance if proper assistance is not available.

US Legal Forms serves as a web-based solution for SC DoR PT-100 e-filing and offers various advantages for taxpayers.

Click the Done button in the upper menu when you have completed it. Save, download, or export the finalized form. Use US Legal Forms to ensure secure and straightforward SC DoR PT-100 completion.

- Find the blank on the website within the designated area or through the search engine.

- Press the orange button to access it and wait until it loads.

- Examine the template and follow the guidelines. If you haven't completed the form before, adhere to the step-by-step instructions.

- Pay attention to the highlighted fields. These are editable and require specific information to be entered. If unsure about what information to provide, consult the instructions.

- Always sign the SC DoR PT-100 form. Utilize the built-in tool to create the electronic signature.

- Select the date field to automatically insert the current date.

- Review the document to verify and make changes before submitting it electronically.

How to alter Get SC DoR PT-100 2016: personalize forms online

Opt for a dependable document editing solution you can rely on. Alter, complete, and endorse Get SC DoR PT-100 2016 safely online.

Often, managing forms like Get SC DoR PT-100 2016 can be a hassle, particularly if you received them digitally or through email but lack specialized tools. Naturally, you can employ some alternatives to navigate around it, but you might end up with a document that doesn’t meet the submission criteria. Using a printer and scanner isn’t feasible either, as it consumes both time and resources.

We offer a more straightforward and efficient method of completing documents. A comprehensive assortment of document templates that are easy to modify and authorize, making them fillable for others. Our service goes beyond just a collection of templates. One of the greatest benefits of utilizing our services is that you can edit Get SC DoR PT-100 2016 directly on our platform.

Being an online-based platform, it frees you from needing to acquire any software on your computer. Additionally, not all corporate guidelines permit downloading it onto your work laptop. Here’s the easiest and most secure way to complete your documents using our solution.

Bid farewell to paper and other ineffective methods of altering your Get SC DoR PT-100 2016 or other documents. Use our tool instead that amalgamates one of the most extensive libraries of readily-customizable templates and robust document editing services. It’s simple and secure, and can save you a lot of time! Don’t just take our word for it, give it a try yourself!

- Click the Get Form > and you will be directly led to our editor.

- Upon opening, initiate the editing process.

- Select check mark or circle, line, arrow, and cross as additional options to mark your form.

- Choose the date option to add a specific date to your document.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields feature on the right to insert fillable fields.

- Select Sign from the top toolbar to create and append your legally-binding signature.

- Click DONE and save, print, share, or obtain the document.

To elect pass-through entity (PTE) status in South Carolina, your business must complete the SC DoR PT-100 form. This election allows business income to pass through to the owners' tax returns, benefiting from lower overall tax rates. It's important to file this election timely, as late submissions may not be accepted. Platforms like uslegalforms can assist you with the necessary forms and compliance, ensuring a smooth process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.