Loading

Get Sc Dor Fs-102 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR FS-102 online

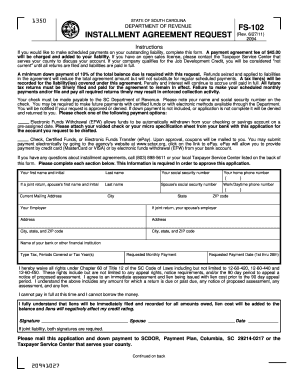

Filling out the SC DoR FS-102 form online is a straightforward process that allows you to request an installment agreement for your outstanding liability. This guide offers clear, step-by-step instructions to help you navigate each section of the form effectively.

Follow the steps to complete your online SC DoR FS-102 form

- Click the 'Get Form' button to access the form and open it for editing.

- Begin by entering your first name and initial, followed by your last name in the designated fields.

- Input your social security number accurately in the provided section.

- Enter your home phone number and, if you are filing a joint return, include your spouse's first name, initial, last name, and their social security number.

- Fill in the work or daytime phone number.

- Complete your current mailing address, including city, state, and ZIP code.

- Provide your employer's name and address, and repeat this step for your spouse's employer if applicable.

- Indicate the name of your bank or financial institution, and select the type of account you will be using for payments (checking or savings).

- Specify the tax periods covered or the tax year(s) relevant to this request.

- Enter the requested monthly payment amount and the payment date (choose a date between the 1st and the 28th of the month).

- Review the waiver statement and affirm that you understand the implications by signing in the designated section.

- If applicable, obtain your spouse's signature for joint liability and complete the date fields.

- Submit any required down payment along with the completed form to the appropriate department.

Complete your SC DoR FS-102 form online today to get started on your installment agreement!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Getting a SC tax exemption certificate requires you to apply through the South Carolina Department of Revenue. Start by completing the required forms available on the SC DoR FS-102 website and submit your application alongside any supporting documents. The department will process your application and issue the certificate if approved.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.