Loading

Get Sc Dor Fs-102 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR FS-102 online

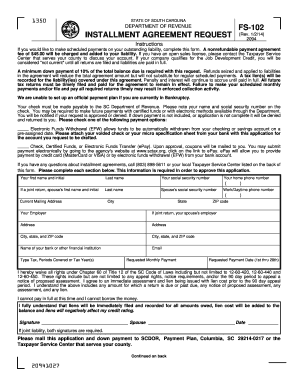

Filling out the SC DoR FS-102 is an essential step for individuals wishing to request an installment agreement for their outstanding tax liabilities. This guide provides clear and supportive instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the SC DoR FS-102 online

- Press the ‘Get Form’ button to access the SC DoR FS-102 and open it in your preferred online editor.

- Start by entering your first name and initial in the designated field, followed by your last name.

- Provide your social security number in the appropriate section to facilitate identification.

- Input your home phone number ensuring the area code is included.

- If applicable, fill out your spouse's first name and initial, followed by their last name and social security number.

- Enter your work or daytime phone number for additional contact.

- Complete your current mailing address, ensuring accuracy for correspondence.

- If filing jointly, include your spouse’s employer's name and their address.

- Specify the name of your bank or financial institution and provide the requested banking details.

- Indicate your requested monthly payment amount and choose a payment date between the 1st and 28th of each month.

- Review the waiver statement regarding appeal rights and sign the form. If applicable, have your spouse sign as well.

- Make sure to mail the completed application along with your down payment to the SCDOR or your local Taxpayer Service Center.

Start filling out the SC DoR FS-102 online today to take control of your tax liabilities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can make payments on your SC state taxes through various methods provided by the SC Department of Revenue. Options include online payments, mail-in payments, or in-person at designated locations. The SC DoR FS-102 offers a structured way to address your tax liabilities. Utilizing services like uslegalforms can simplify this process and help you keep track of your payments.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.