Get Sc Dor Fs-102 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR FS-102 online

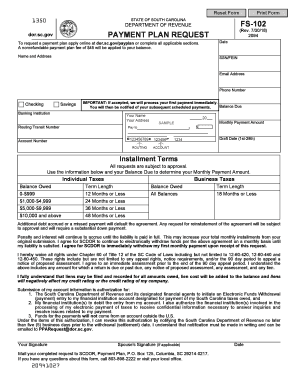

This guide provides a clear and comprehensive overview of how to fill out the SC DoR FS-102 form online. Understanding its components will help you navigate the process smoothly and effectively.

Follow the steps to complete the form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In the 'Date' field, enter the current date.

- Complete the 'Name and Address' section with your full name and address.

- Enter your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) as applicable.

- Provide your email address for updates or communication.

- Fill in your phone number for contact purposes.

- Indicate your preference for account type by selecting either 'Checking' or 'Savings'.

- In the 'Balance Due' field, input the total amount you owe.

- Specify the 'Banking Institution' where the funds will be withdrawn from.

- Determine your 'Monthly Payment Amount' based on the balance due and the installment terms.

- Fill in the 'Routing Transit Number' of your banking institution.

- Provide your 'Account Number' to facilitate payments.

- Select a suitable 'Draft Date' between the 1st and 28th of the month.

- Review the terms and conditions of the payment plan for understanding and compliance.

- Sign the form in the 'Your Signature' field, and if applicable, have your partner sign in the 'Spouse's Signature' field.

- Once completed, save your changes, download a copy, print it, or share the form as needed.

Complete your SC DoR FS-102 online today to manage your payment plan effectively.

Get form

You may owe the SC Department of Revenue for several reasons, such as underreporting income, failing to file a tax return, or not paying estimated taxes. It's crucial to review any notifications you've received from the department to understand your specific situation. Understanding the deductions, credits, or miscalculations that led to your debt can help you resolve the issue efficiently. Resources like US Legal Forms can assist you in understanding your obligations and identifying solutions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.