Loading

Get Sc Dor Cl-1 1999

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR CL-1 online

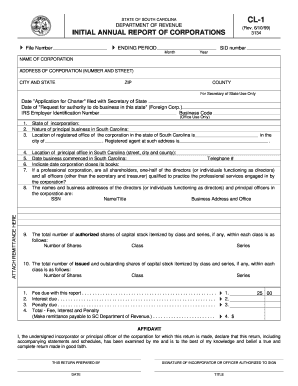

This guide provides detailed instructions on completing the Initial Annual Report of Corporations, also known as the SC DoR CL-1. Whether you are a first-time filer or need a refresher, these steps will help you navigate the online form with ease.

Follow the steps to complete your Initial Annual Report online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your corporation's file number in the designated field. If you do not know your file number, please refer to your initial filing documents.

- Fill in the ending period by selecting the month and year from the dropdown menus. This indicates the end of your corporation's reporting period.

- Complete the fields for the name and address of your corporation, including street number, city, state, and zip code. Ensure that the information is accurate and matches your official records.

- Provide the county where your corporation is registered in South Carolina.

- Input the date of the 'Application for Charter' filed with the Secretary of State. This information is critical for proper record-keeping.

- If your entity is a foreign corporation, enter the date of your 'Request for Authority to Do Business' in this state.

- Enter your IRS Employer Identification Number (EIN). If you have not obtained an EIN, write 'applied for' in the space provided.

- Detail the nature of your principal business in South Carolina and the location of your registered office, specifying the city.

- Indicate whether all shareholders and directors in a professional corporation are qualified to practice the related professional services.

- List the names, titles, and business addresses of all directors and principal officers. If not all positions are filled, indicate the known positions.

- Complete the section for total authorized shares of capital stock by class and series, including the number of shares for each category.

- Indicate the total number of issued and outstanding shares of capital stock following the same format as the previous step.

- Calculate the total fees, interest, and penalties due and indicate the total in the remittance area.

- Affirm the affidavit by signing as the incorporator or the authorized officer, and enter the date and title of the signatory.

- Review all entered information for accuracy. Once confirmed, you can save changes, download, print, or share the form as needed.

Be sure to complete and file your SC DoR CL-1 online to stay compliant with state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out Schedule 1 Line 1, first, gather the required financial information relevant to your business. It's designed to assist in reporting additional income or adjustments. If you find yourself uncertain, the SC DoR CL-1 form or resources on the uslegalforms platform can provide assistance in completing it correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.