Loading

Get Sc Dor C-268 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR C-268 online

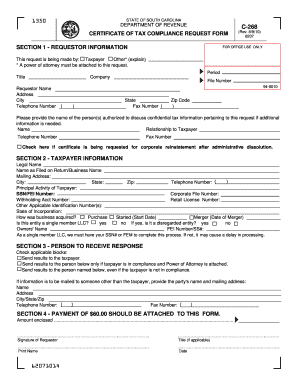

The SC DoR C-268 is a vital document for taxpayers in South Carolina seeking a Certificate of Tax Compliance. This guide provides clear, step-by-step instructions on how to complete the form efficiently online, ensuring compliance and proper documentation.

Follow the steps to complete the SC DoR C-268 online

- Click the ‘Get Form’ button to obtain the SC DoR C-268 form and open it in your online editor.

- Section 1 - Requestor information: Enter the name of the individual making the request, their title (if applicable), company name, address, city, zip code, telephone number, and fax number. Provide the name of any authorized person who can discuss confidential tax information, their relationship to the taxpayer, and their contact information.

- Section 2 - Taxpayer information: Fill in the legal name of the taxpayer, as filed on the return, along with the mailing address. Provide the taxpayer’s principal activity, social security number or federal employer identification number, withholding account number, and state of incorporation. Indicate how the business was acquired, whether the entity is a single-member LLC, and provide any other applicable identification numbers.

- Section 3 - Person to receive response: Select the appropriate option to indicate whether the results should be sent to the taxpayer or another individual. If sending to another individual, provide their full name and mailing address.

- Section 4 - Payment: Attach a non-refundable payment of $60.00. Ensure that the payment is included, as failure to attach it will delay the processing of your request.

- Signature of requestor: Sign and print your name, indicate your title if applicable, and the date. Ensure that the signature corresponds to the person making the request to avoid any processing issues.

- After completing the form, review all entries for accuracy, then save the changes. You may proceed to download, print, or share the completed form as needed.

Complete your SC DoR C-268 form online today to ensure timely processing!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To acquire an exemption certificate, start by accessing the relevant guidelines on the SC DoR website. Complete the required application form, ensuring you provide accurate information to avoid processing delays. Once your application is approved, you will receive your exemption certificate, allowing you to benefit from tax exemptions as defined in SC DoR C-268.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.