Get Sc Dor C-268 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR C-268 online

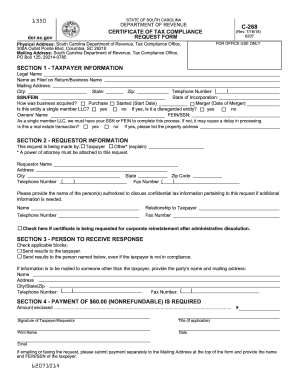

This guide provides a comprehensive overview of the SC DoR C-268 certificate of tax compliance request form, detailing each section so that users can confidently complete the form online. Whether you are familiar with tax forms or new to the process, this guide aims to support you through each step.

Follow the steps to successfully complete the SC DoR C-268 online

- Click the ‘Get Form’ button to access the SC DoR C-268 form online in your editor of choice.

- In Section 1, provide the taxpayer information including the legal name, mailing address, and identification numbers such as SSN or FEIN. Ensure accuracy as this is crucial for processing your request.

- Indicate how the business was acquired by selecting 'Purchase' or 'Merger', and specify dates where applicable. If applicable, confirm if this is a real estate transaction and provide the property address.

- In Section 2, fill in the requestor information, including the name, address, and telephone number of the person making the request. If the requestor is not the taxpayer, a power of attorney must be included.

- Proceed to Section 3 and decide to whom the response should be sent. You can choose to have the results sent to either the taxpayer or another authorized person. Ensure that their name and mailing address are clearly provided.

- In Section 4, confirm the payment of the nonrefundable fee of $60. Enter the amount enclosed and provide your signature as the taxpayer or requestor, along with the printed name and date.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed.

Complete your SC DoR C-268 form online to ensure timely processing.

Get form

To obtain a South Carolina Certificate of Immunization, you can request one from your healthcare provider, or it may be available through your child's school. The SC DoR C-268 may provide additional information regarding vaccination requirements, helping you understand what immunizations are necessary. Ensure you follow the regulatory guidelines to receive your certificate promptly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.