Loading

Get Ca Ftb 5870a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 5870A online

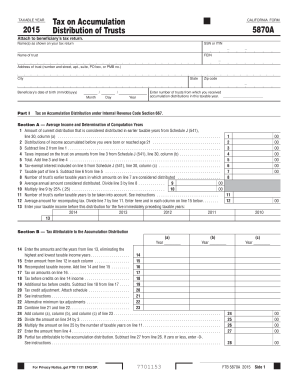

Filling out the California Form FTB 5870A is essential for calculating taxes on accumulation distributions from trusts. This guide will provide a step-by-step approach to help users complete the form accurately and efficiently, promoting a user-friendly experience.

Follow the steps to fill out the CA FTB 5870A online.

- Click 'Get Form' button to access the CA FTB 5870A and open it in your preferred editing interface.

- Begin by filling in the taxable year at the top of the form. Make sure to enter '2015', as indicated.

- Provide the name(s) as shown on the beneficiary's tax return, followed by their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Next, input the name and Federal Employer Identification Number (FEIN) of the trust, along with the trust's address including the city, state, and zip code.

- Input the beneficiary's date of birth in the specified format (mm/dd/yyyy). This information is pertinent for tax calculations.

- Indicate the number of trusts from which you received accumulation distributions in the taxable year by filling in the blank provided.

- Complete Part I by calculating the amounts in Section A, including current distributions from previous taxable years, undistributed net income for periods before the beneficiary was born or reached age 21, and taxes imposed on the trust as required by the form.

- Follow through with Section B if applicable, and complete the calculations for tax attributable to the accumulation distribution as explained in the instructions.

- Finally, review all filled-in sections for accuracy. At the end of the process, you can save your changes, download, print, or share the completed form as necessary.

Take the next step to simplify your tax processes by completing the CA FTB 5870A online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To inquire about setting up a payment plan with the California Franchise Tax Board, you can call their dedicated line at 1-800-689-4776. It’s important to discuss your financial situation to find an appropriate plan that works for you. For related information, exploring CA FTB 5870A can provide additional insights into payment options.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.