Loading

Get Ca Ftb 5870a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 5870A online

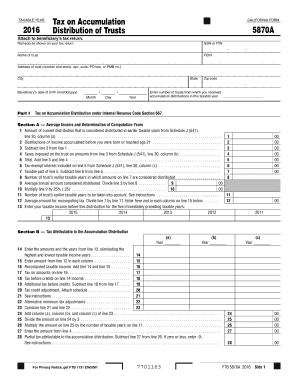

The California FTB 5870A form is used to report tax on accumulation distributions from trusts. This guide will provide clear and user-friendly instructions on how to correctly fill out the form online, ensuring you meet all requirements.

Follow the steps to fill out the form effectively.

- Press the ‘Get Form’ button to obtain the CA FTB 5870A form and open it in your preferred form editor.

- Complete the personal information section by entering the name as shown on your tax return, the social security number or ITIN, the name of the trust, and the trust’s federal employer identification number (FEIN). Also, provide the address with the city, state, and zip code.

- Input the beneficiary’s date of birth in the specified format (mm/dd/yyyy).

- In Part I, indicate the number of trusts from which you received accumulation distributions during the taxable year.

- For Section A, complete lines 1 through 13 by following the provided instructions in the form, which involve calculating distributions and tax amounts based on prior year returns.

- If applicable, complete Section B based on whether the income was accumulated over five taxable years or more. Fill in the relevant lines as instructed.

- Review the entire form for accuracy and completeness before finalizing the entries.

- Once all sections are filled accurately, you can save your changes, download the form, and share or print it as needed.

Complete your CA FTB 5870A form online today to ensure compliance and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The new tax law affecting irrevocable trusts includes changes in taxable income and reporting requirements. These changes may impact the beneficiaries' tax responsibilities, emphasizing the need for diligent record-keeping and compliance. Staying informed about these updates is crucial for effectively managing your trust under provisions such as CA FTB 5870A.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.