Loading

Get 8992 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8992 Form online

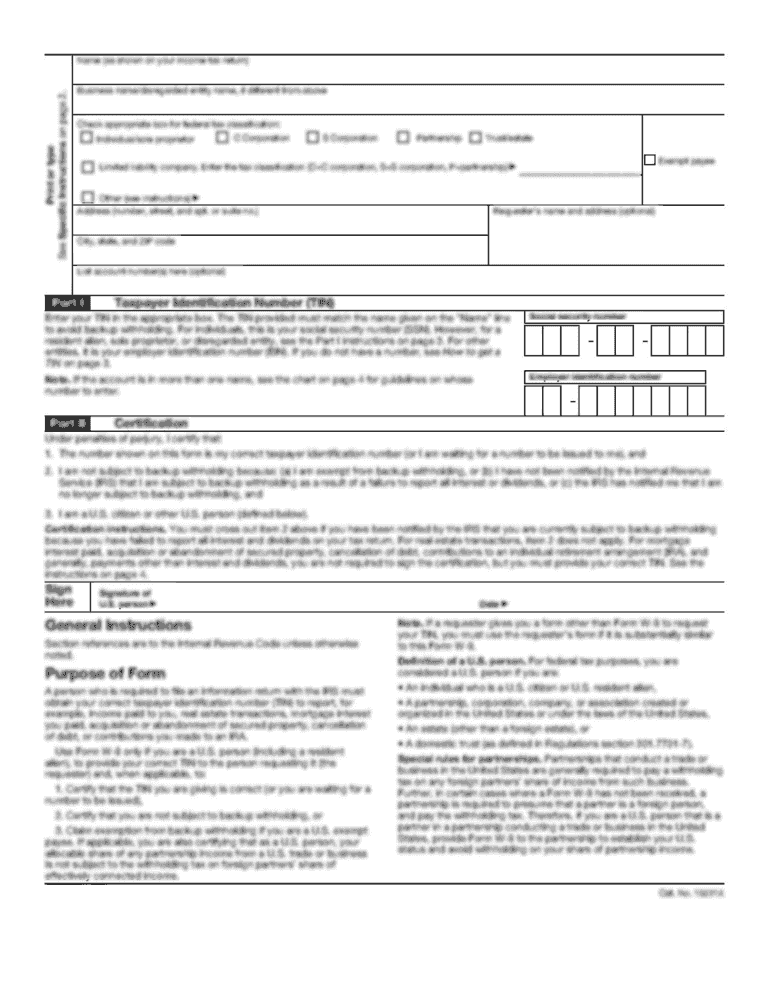

The 8992 Form is essential for calculating the Global Intangible Low-Taxed Income (GILTI) of U.S. shareholders. This guide provides step-by-step instructions on how to complete the form online, ensuring an accurate and efficient filing process.

Follow the steps to complete the 8992 Form effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by entering the name and identifying number of the person filing the return in the designated fields at the top of the form.

- Provide the name and identifying number of the U.S. shareholder, as required in section B.

- In Part I, report the pro rata share of net tested income. Enter the totals from Schedule A, line 1, columns (e) and (f) in lines 1 and 2 respectively.

- Calculate the net CFC tested income by combining the amounts from lines 1 and 2. If the result is zero or negative, you may stop here.

- Proceed to Part II for GILTI calculation. Enter the net CFC tested income from Part I, line 3 in line 1.

- Calculate the deemed tangible income return (DTIR) by taking the total from Schedule A, line 1, column (g) and multiplying it by 10% (0.10). Enter this value in line 2.

- In line 3a and 3b, provide the sum of pro rata share of tested interest expense and income respectively from Schedule A, line 1.

- Calculate specified interest expense in line 3c by subtracting the amount in line 3b from the amount in line 3a. If the result is zero or less, enter -0-.

- Net DTIR is calculated by subtracting the value in line 3c from line 2. If zero or less, enter -0- in line 4.

- Finally, determine the GILTI by subtracting the value in line 4 from line 1 and enter the result in line 5.

- If necessary, complete Schedule A for detailed calculations of net tested income and GILTI allocation. Ensure all relevant fields are filled accurately.

- After all sections are completed, save your changes, and download or print the form as required for submission.

Take action now by filling out the 8992 Form online for an efficient and organized filing experience.

To successfully complete form 8995, begin by carefully reading the instructions provided by the IRS. Fill out the required sections based on your eligibility for the Qualified Business Income deduction. If you need assistance, consider visiting uslegalforms, where you can find resources and guidance focused on filing forms like the 8992 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.