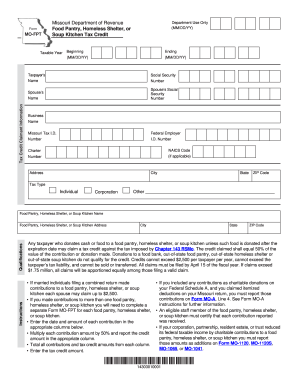

Get Mo Dor Mo-fpt 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MO DoR MO-FPT online

How to fill out and sign MO DoR MO-FPT online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

The era of agonizing intricate legal and tax documents has come to a close. With US Legal Forms, the whole experience of finalizing legal papers is stress-free. A formidable editor is at your service, providing you with an extensive selection of helpful tools for completing a MO DoR MO-FPT. These suggestions, in conjunction with the editor, will guide you through the entire process.

There are numerous methods to obtain the document – as an instant download, an email attachment, or via conventional mail as a printed version. We simplify the process of completing any MO DoR MO-FPT. Start now!

- Press the Get Form button to begin editing.

- Activate the Wizard mode located on the top toolbar to receive additional guidance.

- Complete each fillable section.

- Ensure the details you enter in MO DoR MO-FPT are accurate and current.

- Use the Date tool to add the date to the form.

- Click the Sign icon and create your electronic signature. You have three options: typing, drawing, or capturing one.

- Verify once more that each field has been correctly filled.

- Choose Done in the upper right corner to save or dispatch the document.

How to Alter Get MO DoR MO-FPT 2019: Personalize Forms Online

Utilize the full potential of our powerful online document editor while crafting your forms. Complete the Get MO DoR MO-FPT 2019, focus on the key details, and effortlessly make any other necessary adjustments to its content.

Filling out documents electronically is not only efficient but also provides an opportunity to modify the template per your specifications. If you are about to handle the Get MO DoR MO-FPT 2019, contemplate finishing it with our extensive online editing tools. Whether you commit a mistake or enter the required details in the incorrect section, you can promptly modify the form without the necessity to restart it from the beginning as you would with a manual fill-out. Additionally, you can highlight the crucial information in your document by marking particular parts of content with colors, underlining them, or encircling them.

Follow these quick and straightforward steps to complete and adjust your Get MO DoR MO-FPT 2019 online:

Our robust online solutions are the easiest way to complete and tailor the Get MO DoR MO-FPT 2019 to meet your needs. Use it to prepare personal or professional documents from any location. Open it in a browser, modify your forms, and return to them at any time in the future - they will all be securely stored in the cloud.

- Access the form in the editor.

- Input the necessary details in the vacant sections using Text, Check, and Cross tools.

- Adhere to the document navigation to avoid overlooking any essential sections in the template.

- Encircle some of the significant details and add a URL if required.

- Employ the Highlight or Line tools to emphasize the most important information.

- Choose colors and line thickness to enhance the professional appearance of your form.

- Delete or conceal the information you wish to keep hidden from others.

- Substitute sections of content that have errors and insert the text you need.

- Conclude modifications with the Done option after confirming everything is accurate in the document.

Get form

The MO tax extension form allows taxpayers to request additional time to file their income tax returns. This extension grants you up to six months to submit your return, providing extra time to prepare. Utilizing the MO DoR MO-FPT can simplify your tax filing process, ensuring you meet deadlines while taking the necessary time to gather your information.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.