Get Irs 8302 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

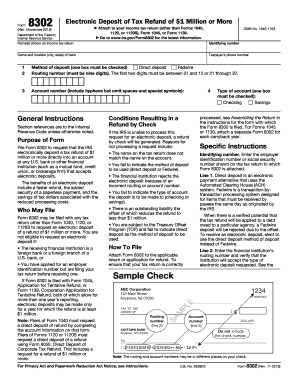

Tips on how to fill out, edit and sign IRS 8302 online

How to fill out and sign IRS 8302 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you still searching for a fast and efficient tool to finish IRS 8302 at an affordable price? Our platform provides you with a comprehensive assortment of forms that are available for completion online. It only requires a few moments.

Follow these straightforward steps to prepare IRS 8302 for submission:

Completing IRS 8302 doesn’t have to be difficult anymore. Now you can easily manage it from your home or workplace directly from your mobile device or computer.

- Select the document you need from our library of legal forms.

- Access the form using our online editing tool.

- Review the guidelines to understand what information you must include.

- Click on the fillable fields and enter the requested details.

- Enter the date and add your electronic signature after completing all sections.

- Review the finalized document for typos and other mistakes. If you need to make any adjustments, the online editor and its wide array of tools are available to you.

- Save the completed form to your device by clicking on Done.

- Submit the electronic form to the designated recipient.

How to alter Get IRS 8302 2018: personalize forms online

Eliminate the chaos from your document routine. Uncover the most efficient method to locate, adjust, and submit a Get IRS 8302 2018.

The task of preparing Get IRS 8302 2018 demands precision and focus, particularly for individuals who are not well-acquainted with such a responsibility. It is crucial to identify a fitting template and complete it with the accurate details. With the right solution for managing documents, you can access all the tools you need. It is straightforward to simplify your editing process without acquiring extra skills.

Locate the appropriate sample of Get IRS 8302 2018 and fill it out promptly without navigating between your browser tabs. Explore additional tools to tailor your Get IRS 8302 2018 form in the editing mode.

While on the Get IRS 8302 2018 page, simply click the Get form button to commence modifications. Enter your details directly into the form, as all the necessary tools are available right here. The template is pre-arranged, so the effort required from the user is minimal. Utilize the interactive fillable fields in the editor to conveniently finalize your paperwork. Just click on the form and transition to the editor mode instantly. Complete the interactive fields, and your document is ready.

Occasionally, a minor mistake can ruin the entire form when someone fills it out manually. Say goodbye to errors in your documents. Discover the samples you require in an instant and complete them digitally using an intelligent modification solution.

- Incorporate more text around the document if necessary. Utilize the Text and Text Box tools to add text in a distinct box.

- Include pre-designed visual elements like Circle, Cross, and Check using their respective tools.

- If needed, capture or upload images to the document with the Image utility.

- If you need to sketch something in the document, use the Line, Arrow, and Draw tools.

- Experiment with the Highlight, Erase, and Blackout options to modify the text in the document.

- If you want to add remarks to specific sections of the document, click on the Sticky tool and place a note where desired.

The IRS may request form 8962 if there are discrepancies related to your premium tax credits. This form is important for reconciling the amount of credit you received against your actual income. If you're confused about this request, consulting with tax professionals or using resources from platforms like U.S. Legal Forms can provide clarity on how to respond accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.