Loading

Get Ma Dor Form Ma Nrcr 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DOR Form MA NRCR online

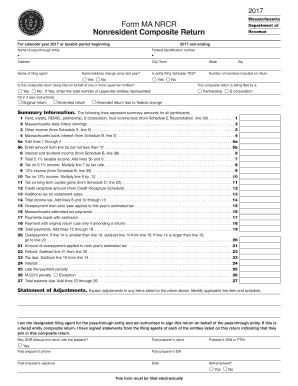

This guide provides a clear and step-by-step approach for filling out the Massachusetts Department of Revenue Form MA NRCR online. Whether you are a seasoned filer or new to tax forms, this guide will support you in the process.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to retrieve the MA NRCR form and access it in your digital editor.

- Begin by entering the federal identification number at the designated field on the form.

- Input the full name and address of the entity filing the return, including city, town, state, and zip code.

- Indicate whether there has been a name/address change since last year by selecting 'Yes' or 'No'.

- If applicable, mark if the entity is filing Schedule TDS by selecting 'Yes' or 'No'.

- Specify the number of members included on this return in the corresponding field.

- For composite returns on behalf of upper-tier entities, indicate 'Yes' and enter total number of upper-tier entities represented.

- Complete the summary information section, entering total amounts for all members on the appropriate lines.

- For income entries such as Massachusetts state lottery winnings or other income, follow the form instructions to report amounts accurately.

- Calculate total taxable income by summing the relevant lines based on the form's provided structure.

- Compute tax owed by applying the respective tax rates to the calculated income.

- Fill out any additional required lines or schedules as instructed, ensuring all figures are accurate.

- Review the form for completeness and accuracy before proceeding to the final steps.

- At the end of the process, save your changes, and use options to download, print, or share the completed form.

Ensure your tax compliance by completing the MA DOR Form MA NRCR online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Massachusetts state tax forms are available from the Massachusetts Department of Revenue's website. Additionally, you can find them at local tax offices and libraries. If you're looking for a streamlined process, the US Legal Forms platform provides access to a variety of state tax forms, including the MA DOR Form MA NRCR.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.