Get Mo Dor Form 53-c 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DOR Form 53-C online

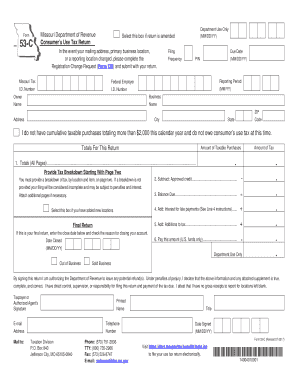

Filling out the Missouri Department of Revenue Form 53-C online can be a straightforward process with the right guidance. This comprehensive guide will walk you through each section of the form, ensuring that you provide accurate information and complete your filing seamlessly.

Follow the steps to effectively fill out the form online.

- Click the ‘Get Form’ button to access the MO DOR Form 53-C and open it in the online editor. This will allow you to begin filling out the required information.

- Start by entering your Missouri Tax I.D. Number, which is an eight-digit identifier issued by the Missouri Department of Revenue. If you do not have one, you may need to register your business first.

- Enter your Federal Employer I.D. Number, which is a nine-digit identifier issued by the IRS. This is required for tax purposes.

- Fill in the filing frequency. This field is optional and can be left blank if you are unsure.

- Provide the due date for the form, which can typically be found on the Missouri Department of Revenue's website.

- Input your reporting period, which corresponds to the tax period for this return.

- Complete the owner and business information by entering the name, address, city, state, and ZIP code. If your business address has changed, refer to the registration change request.

- Indicate whether you do not have cumulative taxable purchases exceeding $2,000 this calendar year by selecting the appropriate checkbox.

- For the totals section, record the amount of taxable purchases and any necessary breakdowns on subsequent pages as required.

- If applicable, provide information about interest for late payments and any additions to tax due, calculating them as per the instructions provided in the form.

- If this is your final return, record the close date and select the reason for closing the business.

- Ensure you sign the form, providing your printed name, title, email, telephone, and the date signed.

- Finalize your form by saving your changes. You can then download, print, or share the form as needed.

Complete your MO DOR Form 53-C online today to ensure your compliance with Missouri tax regulations.

Get form

To report business income, you will generally need to complete Schedule C as part of your tax return. Carefully document all income and applicable expenses associated with your business on this schedule. Maintaining accurate records will ease the reporting process and ensure compliance. Utilizing the MO DOR Form 53-C can clarify any questions during this reporting process, helping you submit a complete and accurate tax return.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.