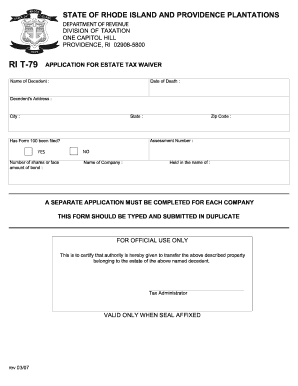

Get Ri Dor T-79 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign RI DoR T-79 online

How to fill out and sign RI DoR T-79 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing tax documents can turn into a significant challenge and considerable nuisance without appropriate guidance provided.

US Legal Forms has been established as an online solution for RI DoR T-79 electronic filing and offers numerous advantages for taxpayers.

Use US Legal Forms to ensure a convenient and straightforward completion of the RI DoR T-79.

- Locate the form on the website in the specific area or through the search function.

- Click on the orange button to access it and wait for it to load.

- Examine the form and follow the instructions. If you have not filled out the form before, follow the step-by-step directions.

- Pay attention to the highlighted fields. They are fillable and require specific information to be entered. If unsure of what to include, consult the instructions.

- Always sign the RI DoR T-79. Use the integrated tool to create your electronic signature.

- Select the date field to automatically enter the correct date.

- Review the form to edit and finalize it before submission.

- Press the Done button in the upper menu when you have finished.

- Save, download, or export the completed document.

How to modify Get RI DoR T-79 2007: personalize forms online

Experience a hassle-free and paperless method of operating with Get RI DoR T-79 2007. Utilize our reliable online tool and conserve a significant amount of time.

Creating each document, including Get RI DoR T-79 2007, from the ground up consumes excessive time, so having a proven alternative of pre-prepared form templates can enhance your productivity.

However, utilizing them can be difficult, particularly with documents in PDF format. Luckily, our comprehensive collection features a built-in editor that allows you to swiftly fill out and modify Get RI DoR T-79 2007 without departing our website, so you don’t have to spend your valuable time finishing your documents. Here’s what you can accomplish with your form using our application:

Whether you need to finalize editable Get RI DoR T-79 2007 or any other form found in our collection, you’re on the correct path with our online document editor. It’s straightforward and secure and doesn’t necessitate specialized skills. Our online solution is structured to handle nearly everything you can think of regarding document modification and completion.

Forget about the conventional way of managing your documents. Opt for a more effective solution to assist you in streamlining your tasks and making them less reliant on paper.

- Step 1. Locate the desired form on our site.

- Step 2. Press Get Form to access it in the editor.

- Step 3. Employ our specific editing tools that enable you to add, remove, comment on and highlight or black out text.

- Step 4. Create and append a legally-binding signature to your document by using the sign feature from the toolbar above.

- Step 5. If the form arrangement doesn’t appear how you would like it, use the options on the right to delete, insert, and rearrange pages.

- Step 6. Add fillable spaces so others can be invited to finish the form (if relevant).

- Step 7. Distribute or send the document, print it, or select the format in which you wish to download the file.

Get form

Filing an estate tax return is not always required, but it depends on the total value of the estate. If the estate does not surpass the exemption limits established by Rhode Island, filing may not be necessary. However, understanding RI DoR T-79’s requirements can help you make an informed decision. Always consult with a legal expert to ensure compliance and to safeguard the estate against unexpected tax issues.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.