Loading

Get Ks Dor Cr-108 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS DoR CR-108 online

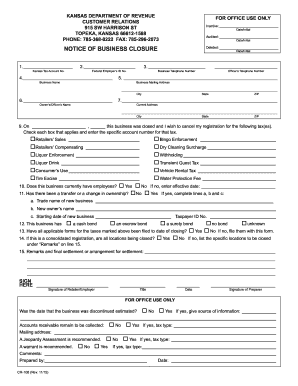

Filling out the Kansas Department of Revenue Customer Relations CR-108 form is essential for notifying the state about the closure of your business. This guide provides step-by-step instructions to help users complete the form accurately and effectively.

Follow the steps to complete the KS DoR CR-108 form online.

- Click the ‘Get Form’ button to access the KS DoR CR-108 form online. This will allow you to open the form in a digital editor.

- Enter the Kansas Tax Account Number in the designated field to identify your business account.

- Input the Federal Employer’s ID Number in the appropriate section. This number is essential for federal tax identification.

- Provide the business telephone number and the officer’s telephone number to ensure contact information is up-to-date.

- Fill in the business name and mailing address, including the city, state, and ZIP code.

- Complete the owner’s or officer’s name and their current address, making sure to include the city, state, and ZIP code.

- Select the relevant tax types applicable to your business closure from the listed options.

- Indicate whether the business currently has employees by selecting 'Yes' or 'No.' If ‘No,’ provide the effective closure date.

- Answer whether there has been a change in ownership. If ‘Yes,’ fill in the required details about the new business, including the trade name and new owner's name.

- Confirm if all applicable tax forms have been filed to the closing date. If not, ensure they are filed with the current form.

- If this is a consolidated registration, specify whether all locations are being closed or list the ones that are not.

- Indicate the type of bond the business has in the remarks section.

- In the remarks section, document any additional information necessary regarding final arrangements or settlements.

- Sign the form in the designated area and include your title and date of signing.

- After completing the form, save your changes, and you can either download, print, or share the completed form as required.

Complete your form online today to ensure a smooth business closure process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Applying for a Kansas sales tax number requires visiting the Kansas Department of Revenue's website. You can complete the application online, providing necessary business information like your federal tax ID. After submitting your application, you will receive your sales tax number, enabling you to collect sales tax legally. Always keep your documentation organized.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.