Get Pr Sc 2800 A 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

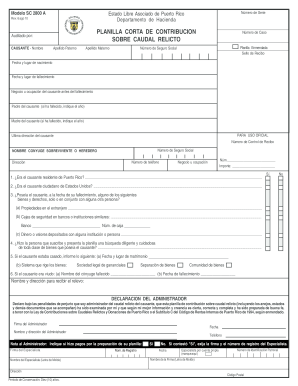

How to fill out the PR SC 2800 A online

Filling out the PR SC 2800 A form can seem daunting, but with a clear understanding of its components and the online filing process, you can complete it smoothly. This guide will walk you through each section, ensuring you have all the necessary information at your fingertips.

Follow the steps to efficiently complete the PR SC 2800 A form online.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Begin by filling out the personal information of the deceased, including their full name, social security number, and date and place of birth. Ensure clarity and accuracy to prevent any processing delays.

- Provide the details regarding the deceased's occupation before passing, ensuring to mention any significant roles that could affect the estate.

- Indicate whether the deceased was a resident of Puerto Rico and a citizen of the United States by selecting 'Yes' or 'No' as appropriate.

- List all properties, bank accounts, securities, and other assets held by the deceased as of their date of death. Include adequate descriptions that allow easy identification, following the specified order of real estate, stocks, and cash deposits.

- Complete the section that pertains to the marital status and relationships of the deceased, including details about surviving spouses or heirs.

- Ensure all necessary declarations are filled out, confirming that you have diligently searched for all assets belonging to the deceased.

- Review all entries for accuracy, and prepare any required supporting documents, including a certification of good tax standing.

- Once all information is entered and verified, you can save changes, download a copy for your records, and then proceed to submit the form online.

Start the process of completing the PR SC 2800 A online today to ensure timely submission.

Get form

Related links form

Yes, if you are a resident of Puerto Rico and meet specific income thresholds, you are required to file a federal tax return. However, your income sourced solely from Puerto Rico is not subject to U.S. federal income tax. It is essential to differentiate between your federal and Puerto Rican taxes to ensure compliance. Utilizing tools like the PR SC 2800 A can help you navigate your obligations effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.