Loading

Get Ca Ftb 565 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 565 online

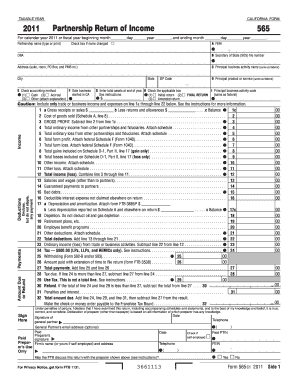

Filling out the CA FTB 565 online can be streamlined with clear guidance. This manual provides step-by-step instructions to ensure users complete the Partnership Return of Income form accurately and efficiently.

Follow the steps to fill out the CA FTB 565 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the taxable year in the correct field. You will need to indicate whether it is for a calendar year or a specific fiscal year. Fill in the month, day, and year for both the beginning and ending of the fiscal year if applicable.

- Provide the partnership name in the designated space, and check the box if there is a name change.

- Fill in the Federal Employer Identification Number (FEIN) and the Secretary of State (SOS) file number. Include any 'Doing Business As' (DBA) names as well.

- In the address section, enter the suite, room, PO Box, and PMB number, followed by the city, state, and ZIP code.

- Specify the principal business activity name and the principal product or service provided by the partnership, ensuring consistency with federal filings.

- Select the accounting method by checking the appropriate box for cash, accrual, or other if you need to provide an explanation.

- Enter the date the business started in California.

- Fill in the total assets at the end of the year and check the applicable return type: initial, final, or amended.

- Continue filling out the income and deductions sections as outlined in the form, ensuring each line is accurate and correlates with your financial records. Attach any required schedules or explanatory notes where specified.

- Upon completing all required sections, review the information for accuracy. Users can then save changes, download, print, or share the form as needed.

Complete your CA FTB 565 forms online to ensure compliance and accuracy in your partnership tax filings.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Tax form CA FTB 565 is the Partnership Return of Income form used to report the income, deductions, and credits of a partnership in California. This form captures essential financial information to ensure accurate tax calculations. Additionally, partnerships must provide their partner's share of items on this form. Utilizing the correct form is vital for compliance and accurate record-keeping.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.