Loading

Get Pr Formulario 480.2 (cpt) 1997

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Formulario 480.2 (CPT) online

This guide provides comprehensive and user-friendly instructions on how to fill out the PR Formulario 480.2 (CPT) online. By following these steps, users with varying levels of experience can navigate the process smoothly.

Follow the steps to complete the PR Formulario 480.2 (CPT) effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the designated online editor.

- Fill in the date fields with the correct year, month, and day. Ensure that your corporation's name, address, and identification number are accurately provided.

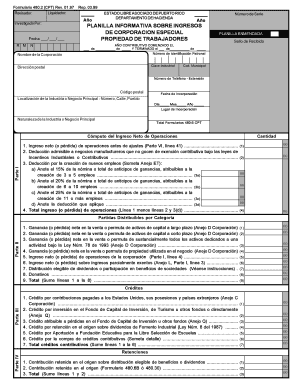

- In Part I, compute the net operating income by entering the figures related to net income, allowable deductions, and any relevant credit for job creation based on the section requirements.

- Proceed to Part II, recording all distributable items by category. Detail gains and losses from the sale or exchange of capital assets and any income from operations.

- Complete Part III by listing any credits applicable, such as credits for contributions paid to various jurisdictions, ensuring you include the necessary supporting documents.

- In Part IV, enter any withholdings or retentions applied on distributions or dividends.

- For Parts V and VI, detail the gross income from sales or production, along with the deductions for expenses directly related to those operations.

- In Part VII, summarize your direct costs. Reflect these totals consistently across the related sections.

- Fill out Part VIII with the comparative balance sheet, ensuring you align current and prior year figures correctly.

- In Part IX, reconcile the net income as per books with the taxable net income indicated in the form.

- Complete Part X by detailing any increases or decreases in capital accounts, ensuring to maintain a clear record for all distributions.

- Finally, fill out the questionnaire in Part XI, ensuring all sections requiring responses are addressed.

- After completing all sections, review the form for accuracy. Once satisfied, save your changes, and download or print the form for submission.

Start filling out your PR Formulario 480.2 (CPT) online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Any individual who earns income in Puerto Rico must file a tax return. This includes residents, part-year residents, and non-residents who have income sourced in Puerto Rico. By using PR Formulario 480.2 (CPT), you can navigate the filing process effectively, ensuring you include all necessary income and deductions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.