Get Pr Formulario 480.2 (cpt) 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR Formulario 480.2 (CPT) online

This guide provides a clear and supportive approach to filling out the PR Formulario 480.2 (CPT) online. By following these detailed steps, users will navigate the form with confidence, ensuring all necessary information is accurately submitted.

Follow the steps to complete the PR Formulario 480.2 (CPT) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

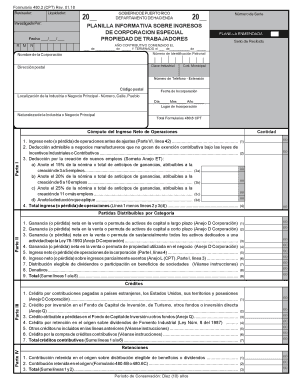

- Fill in the header section with the year of the fiscal period. Indicate the starting and ending date of the fiscal year if it is not a natural year. Enter the corporation's name, postal address, employer identification number, and industrial key.

- In Part I, calculate the net income from operations. Start with the line indicating net income before adjustments, then fill in deductions related to manufacturing businesses, additional deductions for new job creation, and compute the total net income.

- Proceed to Part II and document the distributable items by category. List the net gains or losses from the sale or exchange of long-term and short-term capital assets, total net income from operations, and eligible distributions.

- In Part III, report any credits. Include contributions made to foreign territories, investments in capital, and any other relevant tax credits. Ensure all necessary documentation is attached.

- Complete Part IV on withholdings. Document any contributions withheld on eligible dividends and total them at the end of the section.

- In Part V, detail gross profit from sales, costs of goods sold, and other related incomes. Include the total costs calculated.

- Fill in Part VI with the allowable deductions related to operational costs, detailing further necessary deductions in the provided sections.

- Move to Part VII to list any other direct costs and their total that correlates with the previous sections.

- In Part VIII, complete the comparative state of affairs, documenting both current and prior year’s assets and liabilities.

- Proceed to Part IX for reconciling the net income reported in books with the taxable income as stated in the form.

- Fill out Part X to analyze capital account activities, adding details of income and distribution as required.

- Complete Part XI with the questionnaire, answering all queries regarding record maintenance and compliance.

- Finally, ensure that the form is signed by the appropriate officials. Save your changes, then download, print, or share the completed form.

Complete your PR Formulario 480.2 (CPT) online today to ensure your compliance and streamline your filing process.

Get form

The PR Formulario 480.6 A is a tax form that reports the amount of income for which taxpayers will receive an exemption. This form acts as a declaration for individuals who earn income that qualifies for specific tax exemptions under Puerto Rico law. Proper completion of this form is vital for transparency and compliance during tax season. To streamline this process, uslegalforms offers templates and guides specifically designed for the 480.6 A form.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.