Loading

Get Sc Dor Wh-1606 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR WH-1606 online

This guide provides clear instructions on completing the SC DoR WH-1606 form online. Whether you are a seasoned tax preparer or new to the process, these steps will help ensure your form is filled out accurately and efficiently.

Follow the steps to complete the SC DoR WH-1606 form online.

- Click ‘Get Form’ button to quickly access the SC DoR WH-1606 form and open it in the online editor.

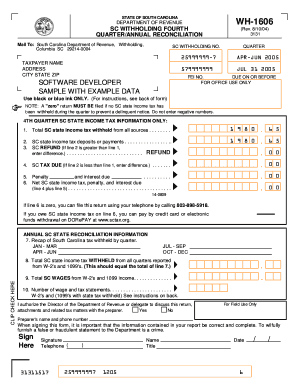

- Enter your South Carolina withholding number in the designated field. This number identifies your withholding account.

- Complete the taxpayer name, address, city, state, and ZIP code fields accurately to ensure proper identification.

- Select the relevant quarter for which you are filing this reconciliation. Ensure the date range corresponds to your reporting period.

- Report total South Carolina state income tax withheld from all sources in line 1.

- Fill in line 2 with the total SC state income tax deposits or payments made for the quarter.

- If applicable, detail any SC refund in line 3. This should only be entered if line 2 exceeds line 1.

- Calculate SC tax due in line 4. If line 1 exceeds line 2, enter the difference here.

- If applicable, enter any penalties and interest in line 5.

- Total the amounts in line 4 and line 5 and enter the final figure in line 6.

- For the annual reconciliation, complete lines 7 through 10 by entering a recap of South Carolina tax withheld by quarter, total SC state income tax withheld, total SC wages from W-2s and 1099s, and the number of wage and tax statements.

- Authorize the Director of the Department of Revenue to discuss your return by checking yes or no as applicable.

- Sign and date the form to validate your submission.

- After completing all fields, save changes, then download, print, or share the form as needed.

Start filling out your SC DoR WH-1606 form online today to ensure timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Receiving a tax refund check usually means you overpaid your taxes throughout the year or qualified for credits that reduced your tax liability. Checking your tax return details can clarify why you received this refund. For specific inquiries regarding your refund, you might consider referring to the SC DoR WH-1606.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.