Loading

Get Pr As 2645.1 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR AS 2645.1 online

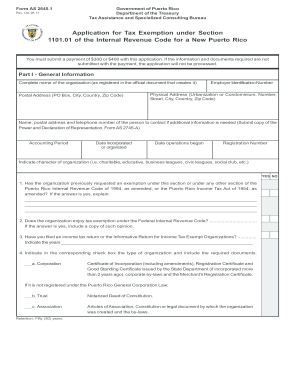

Filling out the PR AS 2645.1 is essential for organizations seeking a tax exemption in Puerto Rico. This guide provides step-by-step instructions to help users navigate the process efficiently and effectively.

Follow the steps to complete your application for tax exemption.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editing tool.

- Begin with Part I - General Information. Fill in the complete name of the organization as listed in its official founding document. Include the postal address, employing the correct format: PO Box, city, country, and zip code.

- Proceed to Part II - Information Concerning Activities and Operations. Describe past, current, and planned activities in detail without quoting the Articles of Incorporation. Specify purpose, timeframe, and location.

- Conclude by signing the declaration section, ensuring the accuracy of the information. Include your title and the date of signing.

Complete your PR AS 2645.1 application online today for a smooth tax exemption process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The personal exemption in Puerto Rico is an amount that taxpayers can deduct from their taxable income, ultimately lowering their tax liability. This exemption is available depending on individual circumstances, such as filing status and income level. Being aware of the rules set by PR AS 2645.1 will help you take full advantage of this benefit.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.