Loading

Get Pr 499 R-4 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 499 R-4 online

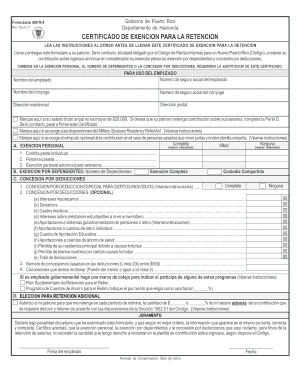

The PR 499 R-4 is a certificate of exemption for withholding, allowing employees in Puerto Rico to inform their employers about their personal exemptions, dependent exemptions, and deductions. Completing this form accurately ensures the correct amount of income tax is withheld from your salary.

Follow the steps to fill out the PR 499 R-4 online

- Press the ‘Get Form’ button to access the PR 499 R-4 document and open it for editing.

- In the top section, provide your full name, social security number, residential address, and mailing address.

- Indicate if your annual gross salary is $20,000 or less by marking the appropriate box.

- If applicable, include your spouse's name and social security number.

- Fill in the exemption details in Part A. Choose your personal exemption status by marking either 'Complete', 'None', or 'Half' as appropriate.

- In Part B, specify the number of dependents. If you share custody, indicate the relevant numbers.

- Provide any deductions in Part C, marking the boxes as applicable and listing the amounts for each category.

- If applicable, in Part D, authorize your employer for any additional withholding from your pay.

- Sign the form and date it. Ensure that all information is accurate before submission.

- Finally, save your changes, download the completed form, print it, or share it as needed.

Complete your forms online to ensure timely and accurate processing.

The percentage you should withhold from your Social Security check typically depends on your total income and tax situation. The recommended withholding rate can vary, and it's important to review your circumstances regularly. For more precise guidance related to your PR 499 R-4 compliance, US Legal Forms can offer helpful templates and information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.