Loading

Get Pr 482.0(c) 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 482.0(C) online

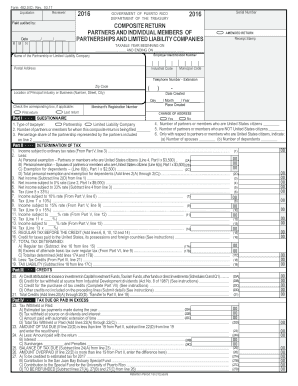

The PR 482.0(C) form is essential for partnerships and limited liability companies filing a composite return on behalf of their partners. This guide provides step-by-step instructions to help you navigate and complete the form accurately online.

Follow the steps to fill out the PR 482.0(C) online.

- Click ‘Get Form’ button to obtain the PR 482.0(C) form and open it in the designated editor.

- Indicate the type of taxpayer by selecting either 'Partnership' or 'Limited Liability Company' in the questionnaire section of Part I.

- Enter the number of partners or members for whom this composite return is being filed in the appropriate field.

- Fill in the number of United States citizens among the partners or members and the number of those who are not.

- Provide the employer identification number, name, and postal address of the partnership or limited liability company.

- Complete Part II, where you will enter the income subject to ordinary tax rates along with any applicable deductions for personal exemptions.

- Move on to Part III to calculate any credits that may apply and provide details as necessary.

- In Part IV, input data on taxes paid or withheld, including estimated tax payments and other applicable tax details.

- Complete Part V by detailing the computation of taxable income, ensuring all income types are accounted for.

- Finally, review all sections, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your PR 482.0(C) online now to ensure compliance and accuracy in your tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filling out a 15c form requires gathering your income and tax information as needed for reporting under PR 482.0(C). You will need to provide relevant details such as residency status, income sources, and any applicable exemptions. If you find this process challenging, platforms like uslegalforms can provide you with step-by-step guidance to ensure accuracy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.