Loading

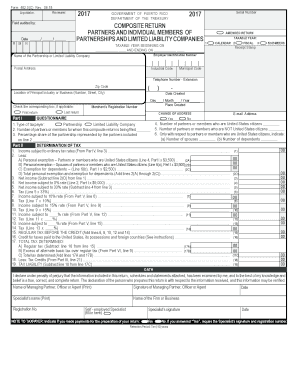

Get Pr 482.0(c) 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 482.0(C) online

This guide provides a comprehensive, step-by-step approach to filling out the PR 482.0(C) online. Whether you are an experienced user or new to tax forms, these instructions will help you navigate the process with confidence.

Follow the steps to successfully complete the PR 482.0(C) online.

- Press the ‘Get Form’ button to access the form and open it in the designated editing interface.

- Begin by entering the name of the Partnership or Limited Liability Company at the top of the form.

- Fill in the Employer Identification Number and complete the postal address fields, ensuring accuracy.

- Specify the taxable year by entering the relevant start and end dates in the designated space.

- Indicate whether this is an amended return by checking the appropriate box.

- In Part I (Questionnaire), indicate the type of taxpayer – whether it is a Partnership or Limited Liability Company.

- Provide the number of partners or members for whom this composite return is being filed in the designated space.

- Complete the number of United States citizen partners and their dependents as required.

- Continue filling out the tax calculations, including personal exemptions and credits in Parts III and IV as applicable.

- In Part V, compute the total income subject to various tax rates according to the guidelines provided.

- Complete Part VI if applicable by calculating the alternate basic tax based on the figures from previous sections.

- Finally, review the entire form for completeness and accuracy, then save your changes, download a copy, or print if necessary.

Complete your PR 482.0(C) online today to ensure compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Puerto Rico is a US territory, and its residents are generally considered US persons, but the tax treatment differs significantly. This unique status can impact your obligations under federal law and local law, especially in terms of PR 482.0(C). If you reside in Puerto Rico, you must comply with local tax regulations even while retaining some connections to the US mainland.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.