Get Id Combined Substitute W-9/direct Deposit/remittance Advice Authorization Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ID Combined Substitute W-9/Direct Deposit/Remittance Advice Authorization Form online

Filling out the ID Combined Substitute W-9/Direct Deposit/Remittance Advice Authorization Form online is a straightforward process. This guide will walk you through each section of the form, ensuring you provide the necessary information accurately and efficiently.

Follow the steps to fill out the form online.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

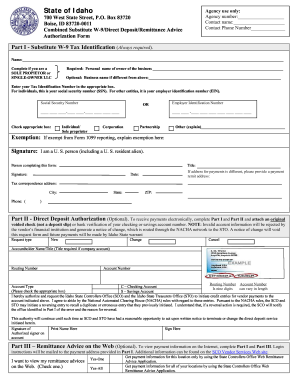

- In Part I - Substitute W-9 Tax Identification, begin by entering your personal name in the designated space. If you are a sole proprietor or a single-owner LLC, include your business name if it differs from your personal name.

- Enter your Tax Identification Number in the appropriate box. Individuals should provide their social security number, while other entities must give their employer identification number. Choose the correct designation by checking the box for Individual/Sole Proprietor or Employer Identification Number.

- If you are exempt from Form 1099 reporting, please explain your exemption in the specified section. Then, sign your name to confirm that you are a U.S. person, including a U.S. resident alien.

- Complete the payment remit address if it is different from your main address. Fill in your city, state, ZIP code, and phone number in the provided fields.

- Move to Part II - Direct Deposit Authorization, if desired. Indicate whether you are setting up a new account, changing an existing account, or canceling direct deposit.

- Provide the Accountholder Name and Title, if applicable. Enter the Routing Number and Account Number based on the voided check or bank verification attached.

- Select the type of account by checking the appropriate box for 'Checking Account' or 'Savings Account'.

- In Part III - Remittance Advice on the Web, indicate if you wish to view your remittance advices online by checking 'Yes-One' or 'Yes-All'.

- Finally, review all the information provided to ensure accuracy. Once confirmed, save your changes, then either download, print, or share the completed form as necessary.

Start filling out your ID Combined Substitute W-9/Direct Deposit/Remittance Advice Authorization Form online to facilitate efficient payment processing.

The difference between a W-9 and a substitute W-9 lies in the format and specific needs of the requester. A W-9 is the official IRS form, while a substitute W-9 provides flexibility for organizations with their own requirements. The ID Combined Substitute W-9/Direct Deposit/Remittance Advice Authorization Form serves as an effective alternative, helping you meet unique reporting demands.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.