Loading

Get Pr 480.6d 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.6D online

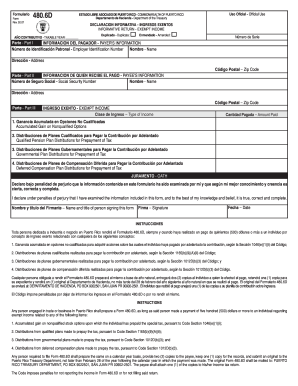

The PR 480.6D is an important form for documenting exempt income in Puerto Rico. This guide provides clear and concise steps to help you fill out the form online with confidence.

Follow the steps to complete the PR 480.6D online effectively.

- Press the ‘Get Form’ button to access the form. This will open the document in an online editor for you to begin filling it out.

- Complete Part I, which includes the payer's information. Enter the employer identification number, name, address, and zip code in the appropriate fields.

- Proceed to Part II. Here, fill in the payee's information by providing their name, social security number, address, and zip code.

- In Part III, specify the type of exempt income. Identify the applicable category from the list provided, such as accumulated gain on nonqualified stock options or distributions from qualified plans.

- For each type of income listed, input the amount paid in the corresponding field next to the income type selected.

- Complete the oath section at the end of the form. Provide the name and title of the person signing the form, along with their signature and the date of signing.

- After confirming all information is accurate, you can save the changes, download, print, or share the completed form as needed.

Complete your forms online for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To establish residency in Puerto Rico for tax purposes, you need to demonstrate a physical presence on the island. Generally, this means living in Puerto Rico for at least 183 days during the tax year. Keep records of your stay and other connections to Puerto Rico. This will help you qualify for local tax benefits and potentially reduce your federal tax obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.