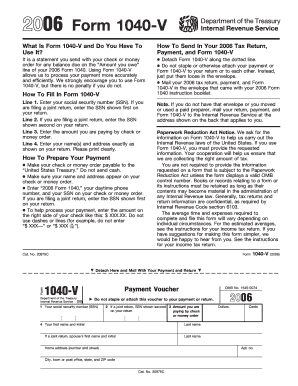

Get Irs 1040-v 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-V online

How to fill out and sign IRS 1040-V online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Have you been attempting to locate a speedy and efficient tool to complete IRS 1040-V at a fair price?

Our service will offer you an extensive selection of templates that are ready for online submission. It only takes a few moments.

Completing IRS 1040-V no longer has to be confusing. From now on, you can easily handle it from your home or office using your mobile device or computer.

- Select the form you require from our assortment of legal forms.

- Access the template in our online editor.

- Review the instructions to understand what information you need to provide.

- Click on the fillable fields and enter the requested details.

- Enter the date and affix your e-signature once you have filled in all other fields.

- Inspect the document for typos and other errors. If you need to amend any information, our online editor along with its diverse tools are available to you.

- Save the finished document to your device by clicking Done.

- Dispatch the e-document to the relevant parties.

How to modify Get IRS 1040-V 2006: personalize forms online

Utilize our comprehensive web-based document editor while preparing your forms. Complete the Get IRS 1040-V 2006, highlight the most important details, and easily make any other necessary adjustments to its content.

Creating documents online is not only efficient but also provides an opportunity to revise the template according to your requirements. If you’re preparing to work on Get IRS 1040-V 2006, consider finalizing it with our powerful online editing tools. Whether you encounter a typographical error or input the requested details in the incorrect section, you can promptly amend the form without starting over as required in manual entry. Additionally, you can emphasize the crucial information in your documentation by highlighting particular segments with colors, underlining them, or encircling them.

Follow these straightforward and fast steps to finish and modify your Get IRS 1040-V 2006 online:

Our extensive online tools are the simplest method to complete and adjust the Get IRS 1040-V 2006 according to your needs. Use it to handle personal or business documents from anywhere. Access it in a browser, make any changes to your documents, and return to them anytime in the future - they will all be securely stored in the cloud.

- Launch the document in the editor.

- Input the necessary details in the empty fields using Text, Check, and Cross tools.

- Navigate through the document to ensure you don’t overlook any essential sections in the template.

- Circle some of the important details and include a URL if necessary.

- Utilize the Highlight or Line tools to emphasize the most important segments of content.

- Choose colors and thickness for these lines to make your form appear professional.

- Remove or obscure the information you don't wish to be seen by others.

- Replace sections of text that contain mistakes and input the required information.

- Conclude modifications with the Done button when you confirm everything is accurate in the document.

Get form

To get your 1040 form online, head to the IRS website where you can find the form readily available under their forms section. You can also utilize tax preparation websites like Us Legal Forms, which offer forms you can fill out online, simplifying your tax preparation process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.