Get Pr 480.2 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.2 online

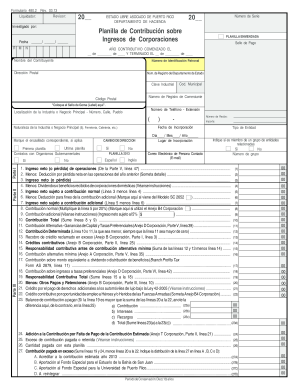

Filling out the PR 480.2 form online is an essential task for corporations in Puerto Rico to ensure compliance with tax regulations. This guide provides clear and supportive instructions to assist users in completing the form accurately and efficiently.

Follow the steps to fill out the PR 480.2 form online

- Press the ‘Get Form’ button to access the PR 480.2 form and open it for editing.

- Carefully read the introductory section to understand the context and requirements for filling out the form.

- Enter the year of the tax period at the top of the form.

- Fill in the taxpayer's name and identification number. Ensure this information matches official records to prevent delays.

- Complete the contact information, including the postal address, email, and phone number of the contact person.

- Indicate whether this is the first return or an amended return by marking the appropriate boxes.

- In Part I, provide details about the corporation's business activities and financial information as required.

- In Part II, gather and report the income details, including net income or losses from operations.

- Proceed to Part III to calculate the total contributions based on the net income declared in the previous parts.

- Verify all entries for accuracy and completeness before saving.

- At the end of the process, save your changes, download the completed form, or print it out for your records.

Complete your PR 480.2 form online today to ensure timely compliance with tax requirements.

Get form

Gaining experience in Puerto Rico can come from immersing yourself in local culture, work environments, or community activities. Networking with local professionals and participating in community events can provide valuable insights and enhance your understanding of the region. Utilizing platforms like uslegalforms can assist in navigating residency requirements and local regulations, enabling you to focus on building your experiences.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.