Loading

Get Pr 480.2 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.2 online

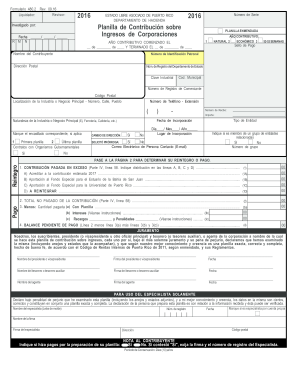

The PR 480.2 is a vital document for corporations in Puerto Rico, used to report income and determine tax liabilities. Filling it out online can streamline the process, ensuring accuracy and efficiency.

Follow the steps to complete the PR 480.2 online.

- Press the ‘Get Form’ button to access the PR 480.2 into your editing interface.

- Begin by entering the year of contribution started and ended, along with the taxpayer's name, ensuring all fields are completed accurately.

- Provide the Employer Identification Number (EIN) and postal address. Include additional details such as registration number and postal code.

- Indicate the type of entity and the nature of the primary industry. Checkmark the applicable boxes for relevant information.

- Complete the income determination sections, including sales, cost of sales, and any applicable deductions. Ensure to follow the line-by-line guidelines.

- Review the balances for tax calculations to determine the contribution owed or the refund amount, if applicable.

- Sign and date the form where indicated, ensuring all necessary signatures from designated officers and agents are included.

- Finalize your submission by saving changes, downloading, or printing the completed PR 480.2 for your records.

Encourage users to complete their documents online for a more streamlined experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To establish residency for tax purposes, you need to live in Puerto Rico for the required days and demonstrate that it is your main home. You should keep records of your days spent in Puerto Rico and your ties to the community. Familiarizing yourself with PR 480.2 can greatly ease this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.