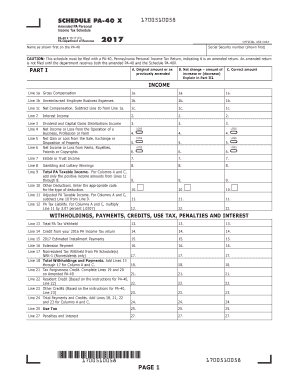

Get Pa Schedule Pa-40x 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA Schedule PA-40X online

How to fill out and sign PA Schedule PA-40X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Filling out a tax form can become a significant barrier and a major hassle if no suitable support is provided. US Legal Forms has been developed as an online solution for PA Schedule PA-40X e-filing and offers multiple advantages for taxpayers.

Utilize the suggestions on how to complete the PA Schedule PA-40X:

Click the Done button in the top menu once you have finished. Save, download, or export the completed form. Use US Legal Forms to ensure an easy and efficient completion of the PA Schedule PA-40X.

- Locate the form on the website within the specific section or by using the Search feature.

- Click the orange button to access it and wait for it to complete loading.

- Examine the form and follow the instructions carefully. If you have never filled out this form before, adhere to the step-by-step guidelines.

- Pay attention to the highlighted fields. They are interactive and require specific information to be entered. If uncertain about the data to provide, consult the instructions.

- Always sign the PA Schedule PA-40X. Use the built-in tool to create your electronic signature.

- Select the date field to automatically insert the correct date.

- Review the document to verify and revise it prior to submission.

How to Revise Get PA Schedule PA-40X 2017: Personalize Forms Online

Streamline your document preparation process and tailor it to your needs with just a few clicks. Fill out and sign Get PA Schedule PA-40X 2017 using an effective yet user-friendly online editor.

Handling documents can be challenging, particularly if you only engage with them sporadically. It requires strict compliance with all regulations and accurately completing all sections with complete and precise information. Nevertheless, there are times when you need to modify the form or add additional fields to fill out. If you want to refine Get PA Schedule PA-40X 2017 before submitting it, utilizing our powerful yet straightforward online editing tools is the best approach.

This extensive PDF editing tool enables you to swiftly and easily complete legal documents from any device connected to the Internet, make essential modifications to the form, and incorporate more fillable fields. The service permits you to select a specific area for each type of data, such as Name, Signature, Currency, and SSN etc. You can set these fields as mandatory or conditional and designate who should fill out each field by assigning them to a specified recipient.

Follow the steps outlined below to update your Get PA Schedule PA-40X 2017 online:

Our editor is a versatile multi-functional online solution that can assist you in effortlessly and swiftly personalizing Get PA Schedule PA-40X 2017 and other templates to suit your needs. Decrease the time spent on document preparation and submission and ensure your documentation appears impeccable with ease.

- Access the necessary document from the directory.

- Complete the blanks with Text and place Check and Cross tools in the tickboxes.

- Utilize the right-side toolbar to modify the form by adding new fillable fields.

- Choose the areas based on the type of data you wish to collect.

- Set these fields as mandatory, optional, or conditional, and adjust their order.

- Assign each section to a specific individual using the Add Signer feature.

- Confirm that you’ve made all the required modifications and click Done.

Get form

Any Pennsylvania resident who earns income, including wages, self-employment income, or interest, must file a PA-40. Additionally, non-residents who earn income from Pennsylvania sources are also required to file. It's important to comply with these regulations to avoid any penalties regarding your PA Schedule PA-40X. Review the filing requirements thoroughly to ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.