Get Irs 433-b (oic) 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 433-B (OIC) online

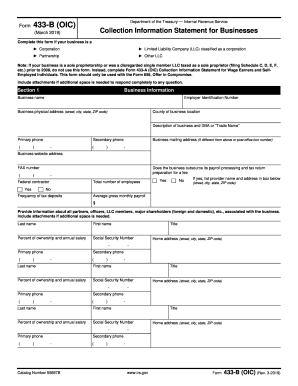

Filling out the IRS 433-B (OIC) form is a necessary step for businesses seeking an offer in compromise with the IRS. This guide provides a clear, step-by-step approach to help users navigate the online form efficiently and accurately.

Follow the steps to complete your IRS 433-B (OIC) form with ease.

- Press the ‘Get Form’ button to access the IRS 433-B (OIC) form online, and open it in your preferred editing tool.

- Begin by entering your business information in Section 1. Fill in the business name, Employer Identification Number, physical address, and other contact details as required.

- Continue to detail all partners, officers, and significant shareholders related to your business. Provide their full names, titles, percentages of ownership, and annual salaries.

- In Section 2, gather and enter information about your business assets. This includes current values of cash, investments, and real estate owned by the business, along with any related liabilities.

- Moving on to Section 3, input your business income details. Sum up average gross monthly income from various sources such as sales, rental income, and other earnings.

- Next, complete Section 4 by detailing your business expenses. Enter the average monthly expenses based on recent financial statements.

- Calculate your minimum offer amount in Section 5 by summing the available assets and future remaining income, ensuring that the amount exceeds zero.

- Provide any additional relevant information in Section 6, which may affect your offer's consideration, including details about bankruptcy or litigation.

- Finalize the document by signing in Section 7, ensuring that you have reviewed all entries for accuracy.

- After completion, save your changes, download a copy of the filled form, and print or share it according to your filing needs.

Begin your IRS 433-B (OIC) form today and ensure accurate submission online.

Get form

IRS Form 433 is used to collect comprehensive financial information about a taxpayer's income, expenses, assets, and liabilities. This form is essential for individuals and businesses assessing their options for resolving tax debts, including Offer in Compromise scenarios involving the IRS 433-B (OIC). Completing this form accurately is vital for negotiating with the IRS. US Legal Forms can support you in the form completion process, making it user-friendly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.