Get Pa Rev-72 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

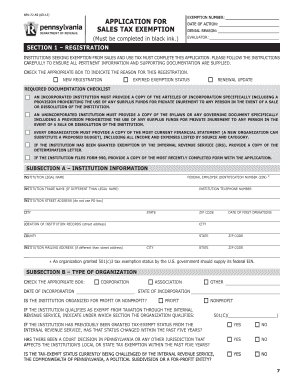

Tips on how to fill out, edit and sign PA REV-72 online

How to fill out and sign PA REV-72 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Filling out tax documents can turn into a significant obstacle and intense nuisance if proper assistance is not provided. US Legal Forms was created as an online resource for PA REV-72 electronic filing and presents various advantages for taxpayers.

Utilize the suggestions on how to finalize the PA REV-72:

Press the Done button on the upper menu when you have finished it. Save, download, or export the finalized form. Use US Legal Forms to ensure a seamless and straightforward PA REV-72 completion.

- Locate the blank form on the website within the respective section or through the search engine.

- Click on the orange button to access it and wait until it is completed.

- Examine the form and adhere to the guidelines. If you have never filled out the form previously, follow the step-by-step instructions.

- Pay attention to the highlighted fields. They are editable and require specific information to be provided. If you are unsure what data to enter, review the guidelines.

- Always sign the PA REV-72. Use the built-in feature to create the electronic signature.

- Select the date field to automatically input the appropriate date.

- Re-read the form to verify and edit it before the electronic submission.

How to alter Get PA REV-72 2012: personalize forms online

Streamline your document preparation process and adjust it to your requirements with just a few clicks. Complete and authorize Get PA REV-72 2012 using an extensive yet user-friendly online editor.

Preparing documents is consistently a hassle, particularly when you deal with it sporadically. It requires you to closely adhere to all protocols and accurately fill in all sections with complete and precise information. However, it frequently happens that you need to modify the form or add additional sections to fill in. If you need to revise Get PA REV-72 2012 prior to submission, the most efficient method is to utilize our powerful yet simple-to-use online editing resources.

This comprehensive PDF editing solution allows you to swiftly and effortlessly finalize legal documents from any internet-enabled device, make minor changes to the form, and incorporate additional fillable sections. The service permits you to designate a specific area for each type of information, like Name, Signature, Currency, and SSN, etc. You can set these as required or conditional and specify who should complete each field by assigning it to a particular recipient.

Our editor is a flexible multi-functional online solution that can assist you in swiftly and easily optimizing Get PA REV-72 2012 along with other templates per your requirements. Enhance document preparation and submission times, ensuring your paperwork appears professional without any complications.

- Access the necessary file from the directory.

- Complete the fields with Text and drag Check and Cross tools onto the checkboxes.

- Utilize the right-hand toolbar to alter the form with new fillable sections.

- Choose the areas based on the category of information you wish to collect.

- Set these fields as mandatory, optional, or conditional, and customize their sequence.

- Assign each area to a specific individual using the Add Signer feature.

- Verify whether you've implemented all necessary changes and click Done.

Get form

Related links form

In most cases, the cancellation of debt is treated as taxable income by the IRS and states, including Pennsylvania. This means that any amount owed that is forgiven must generally be reported on your tax filings. To navigate the complexities associated with cancellation income, refer to PA REV-72, which outlines the obligations and potential exclusions you might qualify for.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.