Loading

Get Pr Sc 2800 C 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR SC 2800 C online

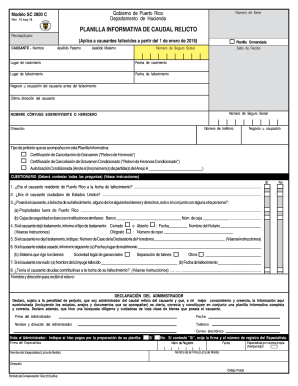

Filling out the PR SC 2800 C form is essential for managing the estate of a deceased individual in Puerto Rico. This guide offers clear instructions for completing the form online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete the PR SC 2800 C form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the deceased person's name, including both paternal and maternal surnames, and their Social Security number. Also, provide their birthplace and date of birth.

- Proceed to fill out the place and date of death, along with the deceased person's last known address and occupation.

- Identify the surviving spouse or heir by entering their name, Social Security number, telephone number, and address.

- Select the type of request you are submitting with the form by checking the appropriate box for Certification of Cancellation of Gravamen, Conditional Certification, or Conditional Authorization.

- Complete the questionnaire section by answering all questions regarding the deceased’s residency status, citizenship, possessions, and any debts they may have had.

- In the Anejo A Caudal Relicto section, provide detailed information about the deceased's assets, including properties and how they were acquired.

- Gather required documentation, including payment receipts, certifications of debt, and the death certificate, ensuring all documents are included before submission.

- Review all completed information for accuracy, and then save changes to the document. You can download, print, or share the filled form as needed.

Complete your PR SC 2800 C form online to ensure a smooth estate management process.

The equivalent of a 1099 in Puerto Rico is the Form 480.6A. This form is essential for reporting income earned from non-employment sources. Using this form correctly aligns with filing requirements and compliance with the Puerto Rican tax system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.