Loading

Get Pa Rev-238 2004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA REV-238 online

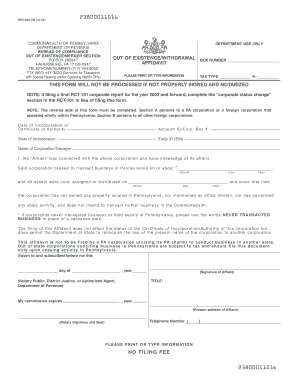

The PA REV-238 form, known as the Out of Existence Withdrawal Affidavit, is a crucial document for corporations wishing to cease operations in Pennsylvania. This guide provides a clear and user-friendly approach to filling out the form online, ensuring you complete each section correctly and efficiently.

Follow the steps to complete the PA REV-238 online

- Click the ‘Get Form’ button to obtain the PA REV-238 and open it in the online editor.

- Fill in the 'Name of Corporation/Taxpayer' field with the complete legal name of your corporation. Ensure accuracy to avoid any processing issues.

- In the 'Date of Incorporation or Certificate of Authority' field, input the original incorporation date of your corporation. This information is vital for identification purposes.

- Enter your 'Account ID/Corp. Box #' to reference your entity within the Pennsylvania Department of Revenue.

- Indicate the 'State of Incorporation' where your corporation was originally established. This helps in confirming the entity's jurisdiction.

- Provide the 'Entity ID (EIN)', which is the Employer Identification Number assigned by the IRS. This number is essential for tax-related filings.

- Complete the cessation date field with the date on which your corporation ceased business transactions in Pennsylvania. If your corporation never conducted any business, use 'NEVER TRANSACTED BUSINESS'.

- Fill in the required sections detailing the distribution of assets. This section covers how the corporation’s assets were handled before ceasing operations.

- Sign and date the affidavit where indicated. The signature must be by the affiant, the person who can verify the information provided.

- Note that the affidavit must be notarized, which requires a notary public, district justice, or authorized agent from the Department of Revenue to validate the signature.

- Once all fields are complete, review the form for any inaccuracies. After ensuring all information is correct, save your changes, and proceed to download, print, or share the completed form as needed.

Start filling out the PA REV-238 online today to ensure your corporate withdrawal is processed promptly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Filling out a withholding exemption form requires careful attention to your financial circumstances. Refer to the PA REV-238 for guidance on determining if you're eligible for exemption based on your income or other factors. Ensure to complete the form accurately and submit it promptly to avoid excess withholding.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.