Get Tx 74-221 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX 74-221 online

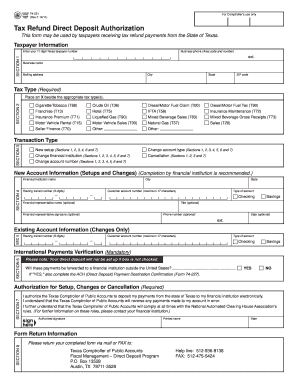

The TX 74-221 form is essential for taxpayers receiving tax refund payments from the State of Texas. This guide provides clear and supportive instructions on how to fill out the form correctly online, ensuring that you can manage your tax refund efficiently.

Follow the steps to complete the TX 74-221 form online.

- Press the ‘Get Form’ button to access the TX 74-221 form and open it in your editing tool.

- In Section 1, provide your 11-digit Texas taxpayer number, business phone number, business name, and mailing address. Ensure that your city, state, and ZIP code are entered accurately.

- In Section 2, indicate your tax type by placing an 'X' in the appropriate box next to the categories that apply to you.

- Select the transaction type in Section 3: choose from new setup, change financial institution, change account number, change account type, or cancellation by marking the corresponding option.

- Fill out Section 4 with new account information if you are setting up or changing an account. Provide the name of your financial institution, city, routing transit number (9 digits), state, customer account number (maximum 17 characters), and type of account (checking or savings).

- If applicable, complete Section 5 with existing account information when making changes. You must enter the routing transit number and customer account number for verification.

- In Section 6, mark 'YES' or 'NO' regarding whether these payments will go to a financial institution outside the United States. If 'YES', ensure to complete the ACH Payment Destination Confirmation (Form 74-227).

- Complete Section 7 by providing your signature as authorization for setup, changes, or cancellation, along with your printed name.

- Finally, review all sections for accuracy. Once completed, you can save the form, download it for records, print a copy, or share it as needed.

Begin filling out your TX 74-221 form online today for a swift tax refund process.

To calculate gross receipts for Texas franchise tax, total all revenue generated by your business, including sales and miscellaneous income. Ensure that you are consistent with the reporting period and include all sources of income. Carefully follow the guidelines set out in TX 74-221 for accuracy. If you need assistance with this process, consider using US Legal Forms, which offers user-friendly resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.