Loading

Get Irs 3911 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 3911 online

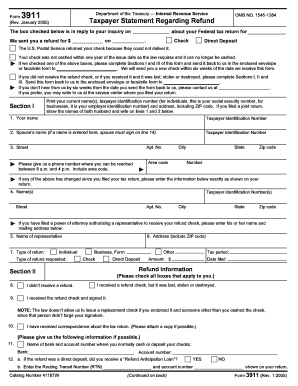

This guide provides clear and supportive instructions for filling out the IRS Form 3911, which is used to request a replacement refund check. Users with varying levels of experience will find detailed steps useful for navigating the online process.

Follow the steps to successfully complete the IRS 3911 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, enter your current name(s) and taxpayer identification number, which is your social security number if you are an individual or your employer identification number if you represent a business. Provide your current address, including the ZIP code. If you filed a joint return, include both names.

- Complete the contact information section by providing A phone number where you can be reached during business hours.

- If any information has changed since you filed your tax return, fill in the new details exactly as they appear on your return in the designated fields.

- If applicable, provide the details of a representative authorized to receive your refund. Include their name and address in the appropriate fields.

- In Section II, check all relevant boxes based on your situation regarding the refund check, such as whether it was lost, stolen, or not received.

- If you normally cash or deposit checks through a bank, indicate the bank's name and account number if possible.

- In Section III, sign the form exactly as you did on the return. If the refund was from a joint return, obtain the required signature from your partner.

- Ensure that you complete the certification statement accurately and provide the date of signing.

- Review the completed form for accuracy. After confirming that all information is correct, save your changes and proceed to download, print, or share the form as needed.

Complete your documents online now to ensure timely processing of your request.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can trace your income tax refund by submitting IRS form 3911. This form serves as your official request to locate your refund. Ensure that you provide accurate information about your tax return and refund details. Following this process ensures that you can track your refund successfully.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.