Loading

Get Vi Annual Report And Computation Of Filing Fee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VI Annual Report and Computation of Filing Fee online

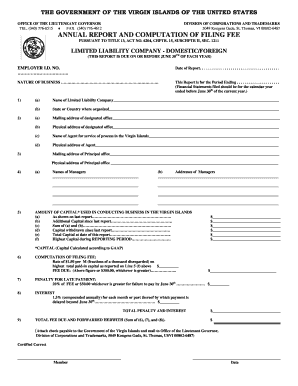

Completing the VI Annual Report and Computation of Filing Fee is an important task for limited liability companies operating in the U.S. Virgin Islands. This guide provides clear, step-by-step instructions to help you fill out the form accurately and submit it online.

Follow the steps to complete the VI Annual Report and Computation of Filing Fee.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Enter your employer identification number (E.I.N.) in the designated field. This number is crucial for identifying your business during the filing process.

- Fill in the 'Date of Report' to indicate when you are submitting the report.

- Provide information on the 'Nature of Business' to describe the primary activities of your company.

- Indicate the reporting period's end date, ensuring it covers the calendar year that concluded before June 30 of the current year.

- Complete Section 1 with the full legal name of your limited liability company and the state or country of organization. Ensure these details match your official documents.

- In Section 2, provide the mailing and physical addresses of your designated office, along with the name and address of the agent for service of process in the Virgin Islands.

- Complete Section 3 with the mailing and physical addresses of your principal office.

- In Section 4, list all managers' names and their corresponding addresses as required.

- Section 5 requires you to detail the amount of capital used in your business. Input your last reported capital, any additional capital, withdrawn capital, and the highest amount of capital during the reporting period.

- In Section 6, calculate the filing fee based on the highest total paid-in capital reported. Remember, the fee is $1.50 per thousand dollars of capital.

- For Section 7, include any penalties for late payments, which is 20% of the fee or a minimum of $50 if payment is late.

- Input interest in Section 8 for each month beyond June 30th that payments are delayed at a rate of 1.5%.

- Sum all findings from Sections 6, 7, and 8 to arrive at the Total Fee Due, which you will submit along with your report.

- Review all entered information for accuracy. Once satisfied, save the changes, download, print, or share the completed form as needed for submission.

Complete your VI Annual Report and Computation of Filing Fee online to ensure compliance and avoid penalties.

Related links form

To get started: Create a business plan. Register your trade name and/or corporation with the Office of the Lieutenant Governor. Select a good location and obtain a copy of an unsigned lease or letter of intent from the owner. Obtain a business license from the V.I. Department of Licensing and Consumer Affairs (DLCA)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.