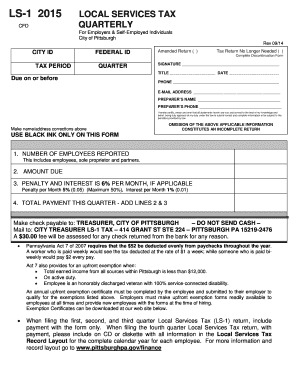

Get Pa Ls-1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign PA LS-1 online

How to fill out and sign PA LS-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing a tax document can become a major issue and a serious nuisance if proper direction is not provided.

US Legal Forms has been created as an online solution for PA LS-1 e-filing and provides numerous advantages for the taxpayers.

Utilize US Legal Forms to ensure an easy and convenient PA LS-1 completion.

- Locate the form on the website within the designated area or through the search engine.

- Press the orange button to access it and wait until it loads completely.

- Examine the form and adhere to the instructions. If you have never completed the template before, follow the detailed instructions line by line.

- Pay attention to the highlighted fields. They are fillable and require specific information to be entered. If you are unsure what to input, consult the guidelines.

- Always endorse the PA LS-1. Utilize the integrated tool to create the electronic signature.

- Click the date field to automatically insert the correct date.

- Re-read the document to verify and make corrections before submission.

- Press the Done button in the upper menu once you have completed it.

- Save, download, or export the finished form.

How to modify Get PA LS-1 2015: personalize forms online

Utilize our robust online document editor to its fullest while preparing your paperwork. Complete the Get PA LS-1 2015, emphasize the most crucial details, and effortlessly make any other necessary changes to its content.

Creating documentation digitally not only saves time but also presents an opportunity to modify the template to fit your needs. If you are about to work on Get PA LS-1 2015, think about finalizing it with our strong online editing tools. Whether you have a typographical error or place the required information in the incorrect section, you can conveniently adjust the form without needing to start over like in manual completion. Furthermore, you can highlight the important data in your document by marking specific parts of content with colors, underlining, or circling them.

Our powerful online solutions are the most efficient way to finalize and adjust Get PA LS-1 2015 according to your specifications. Use it to prepare personal or business documents from anywhere. Access it in a browser, make any modifications to your forms, and return to them at any time in the future - all will be securely stored in the cloud.

- Launch the document in the editor.

- Enter the required information in the blank sections using Text, Check, and Cross tools.

- Follow the document navigation to ensure you don’t overlook any vital segments in the template.

- Circle some of the key details and insert a URL to it if necessary.

- Employ the Highlight or Line tools to emphasize the most significant pieces of content.

- Select colors and thickness for these lines to create a professional appearance for your form.

- Delete or obscure the information you wish to keep hidden from others.

- Replace sections of content that have inaccuracies and type in the text you need.

- Conclude editing with the Done key once you confirm everything is correct in the document.

Get form

Related links form

It's not too late to apply for a rent rebate in Pennsylvania, but specific deadlines do exist. Generally, applications must be submitted by June 30 of the year following the year you are applying for. To ensure you meet all requirements, refer to the Pennsylvania Department of Revenue's guidelines or use the PA LS-1 form to streamline your application process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.