Get Md Sdat Application Homestead Tax Credit Eligibility 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD SDAT Application Homestead Tax Credit Eligibility online

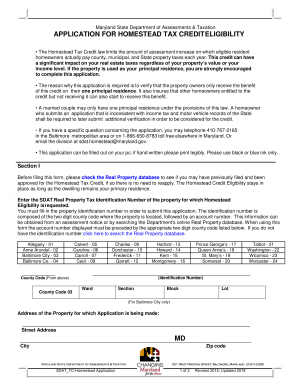

Completing the Maryland State Department of Assessments and Taxation Application for Homestead Tax Credit Eligibility online can streamline the process of ensuring you receive the property tax benefits you may qualify for. This guide provides step-by-step instructions to help you fill out the application accurately and efficiently.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Before proceeding, verify whether you have previously filed for the Homestead Tax Credit by checking the Real Property database. If you have, there is no need to reapply, as eligibility continues as long as the property remains your principal residence.

- Enter the SDAT Real Property Tax Identification Number for the property. This number is crucial for the submission of your application. It consists of the two-digit county code followed by the account number. You can find this information on an assessment notice or by searching the online Real Property database.

- Complete Section I by providing your current address: street address, city, and zip code. Ensure that the details match the information on your property records to avoid discrepancies.

- Move to Section II, where you must answer all questions. Provide the Social Security numbers of all homeowners and spouses, even if not listed as an owner on the deed.

- Answer the questions regarding property use, tax filing locations, driver’s license addresses, voting registration, and rental status accurately.

- List all owners in the provided sections, including printed names and Social Security numbers. If there are more than four owners, attach a separate sheet with the additional details.

- Review the declaration statement before signing. Ensure all provided information is accurate and complete.

- Sign the application as the homeowner and spouse or co-owner, if applicable. Include a daytime telephone number for contact.

- Finally, save your changes, and prepare to submit the application by mail to the address specified in the instructions.

Begin your online application now to secure your potential property tax benefits.

Yes, in Texas, you typically need to provide a valid Texas ID or driver's license when applying for a homestead exemption. This helps confirm your identity and that the property is your primary residence. If you're considering similar tax benefits in Maryland, familiarize yourself with the MD SDAT Application Homestead Tax Credit Eligibility, as it has specific ID and residency requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.