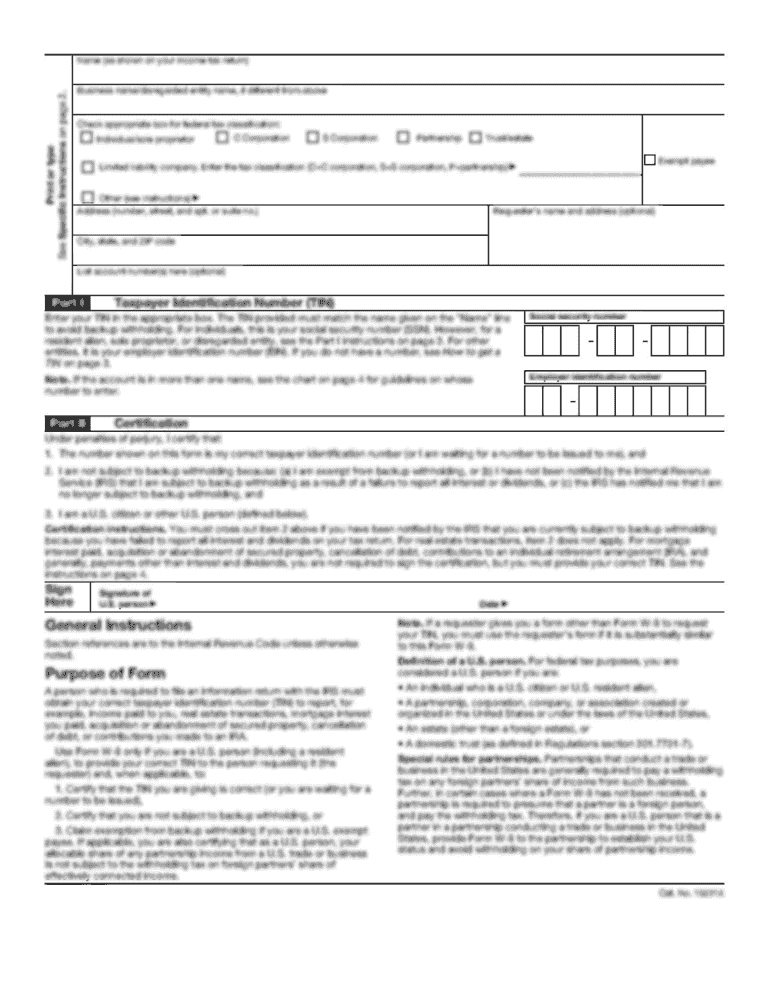

Get Irs 14310 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 14310 online

How to Alter Get IRS 14310 2020: Personalize Forms Online

Experience a stress-free and paperless method of adjusting Get IRS 14310 2020. Utilize our reliable online service and save significant time.

Creating every document, including Get IRS 14310 2020, from the ground up requires excessive effort, so having an established solution with pre-uploaded document templates can significantly enhance your productivity.

However, altering them can pose challenges, particularly with PDF documents. Fortunately, our extensive library offers a built-in editor that allows you to effortlessly complete and modify Get IRS 14310 2020 without leaving our website, ensuring you don't waste time executing your paperwork. Here's what you can accomplish with your file using our tools:

Whether you need to produce editable Get IRS 14310 2020 or any other form in our collection, you're well on your path with our online document editor. It's straightforward and secure, requiring no specialized technical knowledge. Our web-based solution is designed to manage virtually everything you can envision regarding document editing and completion.

Stop relying on outdated methods of handling your forms. Opt for a professional solution to assist you in streamlining your tasks and reducing paper dependency.

- Step 1. Locate the necessary document on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Utilize our advanced editing tools that allow you to add, delete, annotate, and emphasize or obscure text.

- Step 4. Create and append a legally-binding signature to your document using the sign option from the top menu.

- Step 5. If the form layout doesn’t meet your requirements, use the tools on the right to delete, insert, and rearrange pages.

- Step 6. Add fillable fields so others can be invited to fill out the form (if necessary).

- Step 7. Share or send the document, print it out, or select the format in which you'd prefer to receive the document.

Removing an IRS lock requires you to contact the IRS Customer Service, where they will verify your identity and status. Ensure you reference any related IRS 14310 information when speaking with a representative. They will assist you in understanding the necessary steps. For a more streamlined experience, consider leveraging USLegalForms to secure the needed documentation and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.