Loading

Get 2021 Form 941 Pr

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2021 Form 941 Pr online

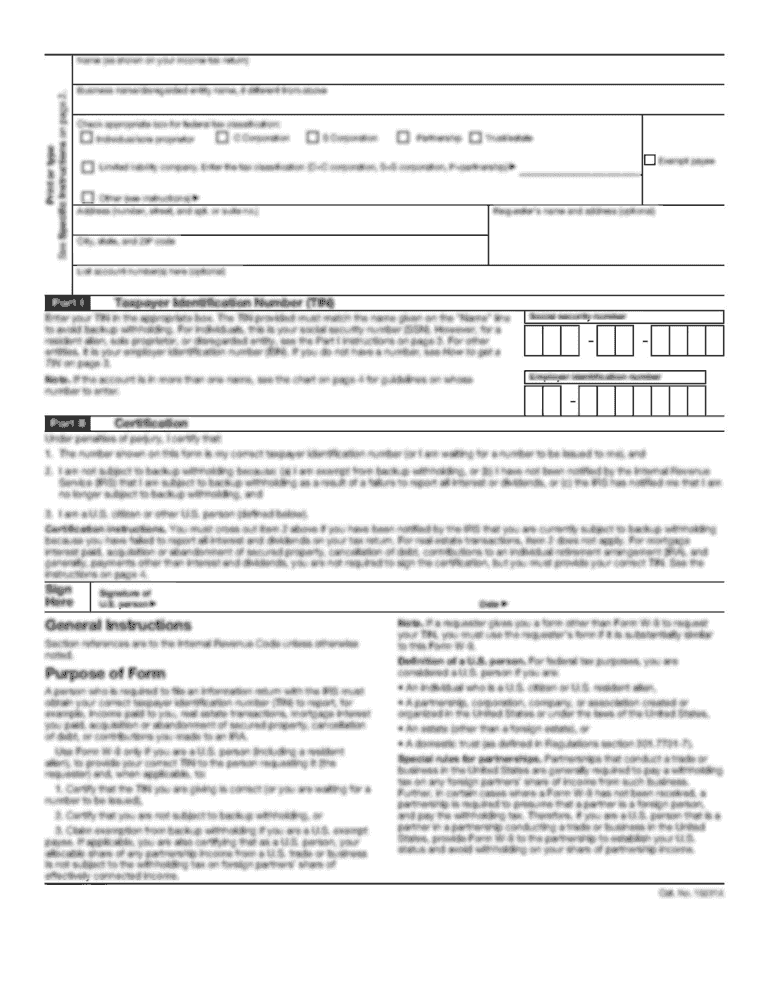

Filling out the 2021 Form 941 Pr is essential for employers to report their federal payroll taxes and ensure compliance with tax regulations. This guide provides a step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete your form

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your Employer Identification Number (EIN) in the designated field. This is crucial as it uniquely identifies your business for tax purposes.

- Fill in your name, which should be the name of the individual responsible for the tax filing, not the business name.

- Provide your business name if applicable, along with the address details: street number, street name, city, state, and ZIP code.

- Indicate the number of employees who received wages, tips, or other compensation during the reporting period.

- Complete the calculation of taxable wages for Social Security and Medicare contributions by filling in the appropriate columns based on employee payroll data.

- Calculate total Social Security and Medicare contributions and enter these values in the section provided. Ensure all adjustments are accurately reflected.

- If applicable, report any non-refundable credits and adjustments related to qualified sick and family leave wages on the specified lines.

- Review the completed sections and ensure all values are accurate, paying close attention to your total tax liabilities.

- Sign and date the form to verify its accuracy under penalty of perjury. If using a paid preparer, ensure they complete their information as well.

- Once all fields are filled and reviewed, you can save changes, download, print, or share the form as needed.

Complete your Form 941 Pr online to ensure timely compliance with tax reporting requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When sending payment for the 2021 Form 941 PR, include the payment with your form submission. Make sure to use the correct payment address, which may differ based on your business type. Utilizing electronic payment options can also streamline the process. If in doubt, check US Legal Forms for specific payment instructions.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.