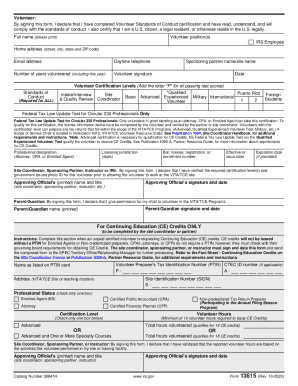

Get Irs 13615 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 13615 online

How to Modify Get IRS 13615 2020: Personalize Forms Online

Utilize our extensive editor to transform a basic online template into a finalized document. Continue reading to discover how to alter Get IRS 13615 2020 online with ease.

Once you locate a suitable Get IRS 13615 2020, all you need to do is tailor the template to your specifications or legal obligations. In addition to filling out the editable form with precise information, you may need to remove certain provisions in the document that are not pertinent to your situation. Alternatively, you might want to incorporate some missing conditions in the original template. Our sophisticated document editing tools are the easiest way to amend and modify the form.

The editor allows you to change the content of any form, even if the file is in PDF format. You can insert and eliminate text, add fillable fields, and make additional adjustments while preserving the original layout of the document. Furthermore, you can rearrange the organization of the form by altering the page sequence.

There’s no requirement to print the Get IRS 13615 2020 to sign it. The editor includes electronic signature functionalities. Most of the forms already contain signature fields. Thus, you simply need to affix your signature and request one from the other signing party with a few clicks.

Follow this step-by-step instruction to create your Get IRS 13615 2020:

Once all parties have completed the document, you will receive a signed copy which you can download, print, and distribute to others.

Our solutions enable you to save a significant amount of time and lessen the chance of an error in your documents. Streamline your document workflows with efficient editing features and a robust eSignature solution.

- Open the selected template.

- Utilize the toolbar to modify the template according to your preferences.

- Fill in the form with precise information.

- Click on the signature field and add your eSignature.

- Send the document for signature to additional signers if necessary.

The IRS does not set a specific monetary value for volunteer hours, as the compensation for volunteer work varies. However, volunteering can provide significant value to organizations and communities, which is often recognized in non-monetary ways. By understanding these contributions and the role of IRS 13615 in documenting volunteer service, organizations can highlight the importance of volunteer work.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.