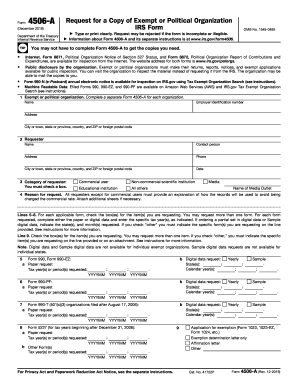

Get Irs 4506-a 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 4506-A online

How to fill out and sign IRS 4506-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Tax, regulatory, commercial, and other electronic documents require enhanced protection and adherence to the law. Our forms are consistently revised to align with the most recent changes in legislation.

Moreover, with our service, all the information you supply in your IRS 4506-A is securely safeguarded against leaks or harm through top-notch file encryption.

Our platform allows you to manage the entire process of submitting legal documents online. As a result, you can save hours (if not days or even weeks) and eliminate unnecessary expenses. Starting now, fill out IRS 4506-A from the comfort of your home, business office, or even while on the go.

- Access the form in the comprehensive online editor by clicking Get form.

- Complete the necessary fields highlighted in yellow.

- Press the arrow labeled Next to navigate from one field to another.

- Utilize the e-signature tool to insert an electronic signature into the form.

- Enter the corresponding date.

- Review the entire template to ensure nothing has been overlooked.

- Click Done and save the completed form.

How to modify Get IRS 4506-A 2019: tailor forms online

Your swiftly adjustable and customizable Get IRS 4506-A 2019 template is at your fingertips. Utilize our repository with an integrated online editor.

Do you delay finishing Get IRS 4506-A 2019 because you simply don’t know where to begin and how to progress? We empathize with your situation and have an outstanding tool for you that has nothing to do with overcoming your hesitation!

Our online collection of ready-to-edit templates allows you to browse through and select from countless fillable forms designed for a range of applications and scenarios. However, obtaining the document is merely the beginning. We provide you with all the necessary instruments to complete, certify, and alter the document of your preference without leaving our platform.

All you have to do is open the document in the editor. Review the wording of Get IRS 4506-A 2019 and verify if it's what you’re looking for. Start filling out the form by utilizing the annotation tools to give your document a more structured and tidy appearance.

In summary, along with Get IRS 4506-A 2019, you’ll receive:

With our professional tool, your finalized documents are always legally binding and fully encrypted. We ensure the protection of your most confidential information.

Acquire everything you need to produce a professional-looking Get IRS 4506-A 2019. Make the right decision and explore our system today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, obscure, and edit the existing text.

- If the document is intended for other users as well, you can incorporate fillable fields and share them for others to complete.

- Once you’re finished completing the template, you can obtain the document in any available format or select from various sharing or delivery options.

- A robust suite of editing and annotation tools.

- An integrated legally-binding eSignature solution.

- The capability to create documents from scratch or based on pre-uploaded templates.

- Compatibility with diverse platforms and devices for enhanced convenience.

- Multiple options for safeguarding your files.

- A variety of delivery options for simpler sharing and distribution of documents.

- Adherence to eSignature regulations governing the usage of eSignature in electronic transactions.

The 4506 form is used to obtain copies of tax returns and tax account information from the IRS. It is especially useful for individuals and businesses needing documentation for financial purposes. Utilize the IRS 4506-A form with US Legal Forms to easily navigate this request and receive the needed information promptly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.